Report on Portfolio Construction and Analysis

Understanding of the underlying financial concept

Investment Portfolio is a passive investment portfolio under which different collection of assets like bonds, stocks, and real estate, etc are owned by an individual and also by institutions.

The assets are considered as important for the investors in which investment of money is done in an efficient manner. On the other side, Chen et al. (2018) also elaborated that the investment in the portfolio is done to achieve the financial again instead of foreign direct investment. This investment allows the investors to exercise a specific degree of managerial control over the company respectively.

At the same time, Chandra (2017) explained that the investors mainly focus on the investment portfolio which helps them in making an effective decision related to the investment and return & risk on it.

For the client, it is very important to construct a proper portfolio because it is a systematic, disciplined and personalized process which helps in characterizing the individual risk and return related to underlying investment.

The construction of the investment portfolio for the investor helps in risk tolerance of the client. As per Betschinger (2015), the risk tolerance is considered an amount of variability & fluctuation which helps in handling the investment efficiently.

Moreover, Davies et al. (2016) stated that portfolio analysis is also necessary for the investor for identifying the best suitable assets under which risk is limited and return is higher than expected. The investment in the portfolio is mostly done by the investor for the proper planning of future retirement.

But at the same time, there are different types of investment portfolio which are constructed as per client requirements such as aggressive portfolio, defensive portfolio, income portfolio, hybrid portfolio and speculative portfolio (Emons, 2015).

These all stated types of the portfolio have a different purpose for the investor as there are various ways on the basis of which these portfolios are diversified respectively.

Determine the client initial portfolio could be improved and different investment opportunities can be created

The initial portfolio is an initial stage of constructing a portfolio which includes different investment opportunities for the client where they can invest their money safely or securely for attaining better future return.

The initial portfolio is drafted as per the client planning for retirement earnings and benefits (Li et al., 2015). In addition, the initial portfolio could be optimized by the client in an efficient manner by bringing the required changes in the allocation of assets like the number of shares, etc.

In concern of this, the initial portfolio constructed for the client from which yearly average return for the investment is calculated for determining the best suitable asset of the company in which investor can invest.

| Yearly Average Returns | |||||||

| AND.L | HL.L | RMV.L | ITE.L | BOY.L | SN.L | HLMA.L | ITV.L |

| 0.288846 | 0.408708 | 0.239495 | 0.171255 | -0.07573 | 0.28538 | -0.22857 | -0.30413 |

However, the above-stated table clearly demonstrates that from 8 different companies, only 5 companies are showing average return and from that also only HL.L (Hargreaves Lansdown PlC) is only providing a high rate of return on the investment.

In a similar manner, if the quantity of the shares of the Aberdeen Asset Management Plc gets decreased then the level of risk will get reduce and changes of high return can be attained.

| Risk | Return |

| 0.05454 | 0.041221 |

On the other hand, the above table states that the overall initial constructed portfolio will provide high return but there is more risk involved and that is a challenge for the company respectively.

In regards to this, the client initial portfolio could be improved by following different ways which influence the investment decision of the client to a large extent. The first way to the client to improve the investment portfolio is to allocate the assets as per the expected risk or return respectively.

The allocation of the asset is very important as per the proportion of different assets in a portfolio as well as on the basis of the different factors respectively.

On the other side, the quality and quantity is another way in the portfolio which could be considered and improved for making a decision of investment efficiently (Zavertiaeva, 2016).

This way can enhance the portfolio and influence the client to differentiate between the effective and ugly portfolio and refine as per awesome portfolio. In addition, the other investment opportunities for the client could be created by proper analysis of the rate of return and risk which is associated with the existing investment.

For proper analysis, the best suitable investment portfolio strategy could be used for bringing improvement such as technical analysis (Kvist, 2015). The use of technical analysis often influences the charts to recognize the current market trend and price pattern in order to predict the future return or trend respectively.

Discuss the advantages and disadvantages of different portfolios for the investors

While discussing the investment, Guerard Jr et al. mentions that there several types of investment options are available in the market that can be effective for the investors.

In addition, portfolio construction is the best option for individuals or businesses through including a variety of assets. In this, different portfolios help the investors to spread the risk comfortably.

As a broker, it is advised to the investors diversified its portfolio through investing in different securities. In a similar manner, the advantages and disadvantages of the different portfolio are as follows:

Initial Portfolio

It is developed at the time of establishing the business in its initial days. With this, individual or businesses can invest their savings after all expenses and fulfilling all the responsibilities. This is done for reaching to generate income (Purnus & Bodea, 2015).

At the same time, it has some disadvantages as this kind of portfolio is developed with a small investment and with less risk expectation because it is constructed in the very first time. In this, the risk is very high as the investor does not have sufficient knowledge about the investment.

Minimum Variance Portfolio

It is referred to as the spread of investment along with the lowest volatilities. This is especially for those who do not have the capability to bear high risk and that is the reason to prefer the lowest sensitivities risk.

It is the ideal choice of individuals because it has less risk but at the same time, this minimum variance portfolio contains the fewer variances that mean prices of securities are same at all time so there are fewer chances of more profit because more risk taker earns more profit.

Optimal Portfolio

Under the optimal portfolio, it is reflected that the risk is equal to gain that means the balance is maintained between risk and gain. This kind of portfolio is mostly proffered by the investors because as per the optimal portfolio, it has the highest probable potential return at a provided level of risk (Bampinas & Panagiotidis, 2016).

The optimal portfolio has the benefits as it manages risk and returns so that loss cannot be faced by the investor. Apart from this, Due to the optimal portfolio, there are fewer changes to get an effective return from an investor’s return.

Compare the two efficient frontiers and make an observation on their differences

In concern of efficient frontier, it is identified as the set of optimal portfolios which provides the highest expected return in concern of defined level of risk as well as the lowest risk for a given level of execrated return.

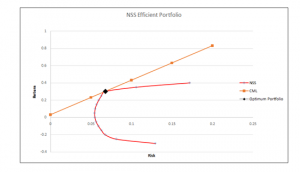

As per the given data, two efficient frontiers are NSS Optimum Portfolio and SS Optimum Portfolio that are combined in this case for producing the maximum expected return at a given level of risk (Martins et al., 2016). After analyzing the data in concern of efficient frontier, some important facts are identified that are given below:

Under NSS Efficient Portfolio, it is determined that the individual return of this portfolio is 0.302 but at the same time, this portfolio contains the risk 0.068 that is not high as per the return. In this way, the ratio between return and risk is 4.451.

In addition, to above, it is found that the SS efficient portfolio has less variance in comparison to CML as per the above graph. In this, it is also determined that the SS optimal portfolio has 11.864 return with 1.771 risk that is quite enough for the investors. In this way, the ratio of risk and return is 6.698.

In the end, it is determined from the above graph that between NSS Optimal Portfolio and SS optimal Portfolio, the SS efficient frontier has more return in against of NSS efficient frontier. This is the best option as per the provided data (Weatherill et al., 2015).

After discussing all the important facts, it can be recommended as the broker that SS optimal portfolio is the best selection in concern of the investor as it provides the best return but at the same time, it contains the relatively high risk in it that can be handled by the investors for getting the highest return from its investment.

In addition, it is also mentioned that the client should also invest its funds in HL.L Company as it provides more return in comparison to other companies.

Bampinas, G., & Panagiotidis, T. (2016). Hedging inflation with individual US stocks: A long-run portfolio analysis. The North American Journal of Economics and Finance, 37, 374-392.

Betschinger, M. A. (2015). Do banks matter for the risk of a firm’s investment portfolio? Evidence from foreign direct investment programs. Strategic Management Journal, 36(8), 1264-1276.

Chandra, P. (2017). Investment analysis and portfolio management. USA: McGraw-Hill Education.

Chen, T., Zhu, Y., & Teng, J. (2018). Beetle swarm optimization for solving investment portfolio problems. The Journal of Engineering, 2018(16), 1600-1605.

Davies, R. J., Kat, H. M., & Lu, S. (2016). Fund of hedge funds portfolio selection: A multiple-objective approach. In Derivatives and Hedge Funds (pp. 45-71). USA: Palgrave Macmillan, London.

Emons, B. (2015). Mastering Stocks and Bonds: Understanding how Asset Cross-over Strategies Will Improve Your Portfolio’s Performance. USA: Springer.

Guerard Jr, J. B., Markowitz, H., & Xu, G. (2015). Earnings forecasting in a global stock selection model and efficient portfolio construction and management. International Journal of Forecasting, 31(2), 550-560.

Kvist, J. (2015). A framework for social investment strategies: Integrating generational, life course and gender perspectives in the EU social investment strategy. Comparative European Politics, 13(1), 131-149.

Li, J. C., Long, C., & Chen, X. D. (2015). The returns and risks of investment portfolio in stock market crashes. Physica A: Statistical Mechanics and its Applications, 427, 282-288.

Martins, C. L., de Almeida, J. A., de Oliveira Bortoluzzi, M. B., & de Almeida, A. T. (2016, May). Scaling issues in MCDM portfolio analysis with additive aggregation. In International Conference on Decision Support System Technology (pp. 100-110). Springer, Cham.

Purnus, A., & Bodea, C. N. (2015). Financial management of the construction projects: A proposed cash flow analysis model at project portfolio level. Organization, technology & management in construction: an international journal, 7(1), 1217-1227.

Weatherill, G. A., Silva, V., Crowley, H., & Bazzurro, P. (2015). Exploring the impact of spatial correlations and uncertainties for portfolio analysis in probabilistic seismic loss estimation. Bulletin of Earthquake Engineering, 13(4), 957-981.

Zavertiaeva, M. (2016). Portfolio forming decisions: the role of intellectual capital. Journal of Intellectual Capital, 17(3), 439-456.