REPORT ON REVENUE AND SPENDING VARIANCE OF THE TWIN RIVERS CAFÉ

Executive Summary

In this report the budget control plan for Twins River Café have been analyzed. The estimation of cost for different expenses has been evaluated. The main objective and aim of planning a budget control for Twin Rivers Café have been discussed with clear identifications to the companies’ budget report. The budget report has been further analyzed and all the expense have been identified that can be managed and controlled by the company. Advice and ideas have been provided to the management team of the café to analyze and understand the areas of expenses that needs to be controlled to increase efficiency in budget control.

Budget is a guideline to achieve a target made by organization to fulfill future prospective. Budget can be used in different scenarios, such as for marketing but it is broadly used by the management of organization to determine the performance of organization. Estimation of cost and revenue for a specific time period is called Budget It motivates management to put an extra effort to achieve better performance in future. Purpose of budgeting for organization can be to allocate resources, future planning, communication. An organization also implements budget to take their essential financial decisions. The process of budget begins with establishing assumption for an upcoming period of time. The assumptions are related to organization’s sales pattern, cost pattern, current or upcoming economic scenario, competitive organization’s behavior. Production of organization follows budgeted guidelines to meet goals of organization. It is also a useful tool to reduce errors of an organization.

The overall objective of budgeting is to plan future targets and allocate according to planned budget to achieve targeted goal. Budget is an essential part of planning. Predicting future revenue, expenditure on production and other expenses to earn maximum income and minimize the possible loss is one of the main objectives of planning budget. Budget is a helpful tool for forecasting organization’s future financial condition and future needs of funds (Naldi, Nicosia, and Pferschy, 2016, p.67). The organization’s possible future insolvency can be avoided by providing proper budget on finance (Sze, In and Yan, 2015, p129). It is a great decision making tool as budget helps to decide where to focus in a situation of dilemma. It helps to decide the capitalization composition for funds availability at a reasonable cost. The common objective of a budget is it coordinates the efforts of different departments (Tan and Ma, 2019, p.37). Budget fixes responsibilities of different divisions of organization. Efficiency and flexibility of operations of different departments of an organization increases due to fix responsibility of each department (Mutambatuwisi et.al 2016, p.3). It ensures effective control on inventory and liquid cash of organisation. Centralised control over the whole organisation is possible through the budgetary system.

3. Report and initial analysis

This report is based on The Twin Rivers Cafe’s revenue and spending variance for the month ended July, 2018. The organization expected to sell 18000 units of meal in the month but The Twin Rivers Cafe only able to sale 17800 units of meal in the month (Samuels and Sawers, 2017, P.52). The Twin Rivers Cafe has fixed price for meals that is £4.50 per meal. The organization expected to earn revenue £81000 but the organization able to earn revenue of £80100 throughout the month. The expenses of the organization are two types, some are fixed expenses and some are variable expenses. Expenses on raw material are £2.40 per meal. The expenses on raw material expected to be £43200 but the actual expense occurred £42720. Expenses on wages and salary consist of some fixed expenses and variable expenses (Naldin et al. 2016, p.66). The fixed expenses on wages and salary are £5200 and the variable cost is £0.30 per meal. The total expenses on wages and salary expected to be £10600 but actually The Twin Rivers Cafe has spent £10540.

Figure 1: Total Expenses

(Source: Created by Researcher)

The organization expected utilities expenses £3300 which is included a £2400 fixed expenses and remaining expenses are £0.05 per meal, although the total utilities expenses incurred £3290. The actual facility rent is £5100 which was expected to be £4300 (Gachokan et al. 2018, p.4). The Twin Rivers Cafe has an expense on insurance which was expected to be £2300 but the actual expenses on insurance occurred £2600. The expenses on fuel was planned by the organization £2480 where the actual expenses is £2490. Net operating income is the income after deducting all expenses from total revenue (Ardini and Dewi, 2017, p.9). The net operating income was expected to be £14820 but as a result of variances in expenses and revenue, the actual net operating income occurred only £13360. Variances in both revenue and expenses are observed in The Twin Rivers Cafe’s cost report for the month of July, 2018 (Siahaan, 2018, p.65).

Figure 2: Total Income

(Source: Created by Researcher)

4. Further analysis and consideration

The Twin River Cafe has planned budget for the month of July, 2018 but in actual budget many variances is observable. The first and main reason of variance is low unit of meal sales throughout the month. The quantity of meal was expected to be sale was 18000 units but the organization was able to sell only 17800 units (Tan and Ma, 2019, p.25). The organization is unable to sell 200 units of meal throughout the month. The result of fewer sales reflected on total revenue of the organization which is decreased by £900. The total revenue was expected £81000 but the organization able to earn £80100. The difference between expected revenue and actual revenue is 200 x £4.50, that is £900. The total expense on raw materials was also changed due to low sale of meal. The expected cost on raw material was £43200 and the actual cost on raw material is £42720. The expenses on raw material are £2.40 per meal. The variance on expenses of raw material is 200 x £2.40, that is £480.

Figure 3: Meals Quantity

(Source: Created by Researcher)

The expenses on wages and salaries include some fixed cost and variable cost (Wynen and Verhoest, 2016, p.539). It is also observed that the organization able to meet the fixed cost of wages and salary however the variable cost has changed due to low sale. The fixed cost on salary and wages is £5200 and the variable cost is £0.30 per meal. The difference of wages and salaries is 200 x £0.30, that is £60 (Zijlstra, 2016, p.65). The utility expenses is also consists of two types of expenses, that is fixed expenses of £2400 and variable expenses of £0.05 per meal. The organization able to meet the fixed cost of utilities expenses but fail to attain variable expenses of 200 x 0.05, which is £10. The Twin River Cafe has expected expenses on facility rent of £4300 however the expense has increased throughout the year (Lonardi et al. 2018, p.4099).. The actual expenses on facility rent are £5100 which higher than expected expenses by £5100 – £4300, that is £800. The Twin River Cafe has expected an expense on insurance of £2300 but the expense has increased to £2600. The difference of insurance expenses is £2600 – £2300, that is £300. The organization expected to spend £2480 on fuel however the expenses slightly increased to £2490 by £10. The analysis clearly shows that the variances incurred mainly because of change in sale quantity (Ter Bogt et al. 2015, p.289). The variable costs are mainly changed because of difference in sale quantity however some fixed expenses increased which must be concern of management. Fixed expenses such as facility rent, insurance and fuel expenses have increased.

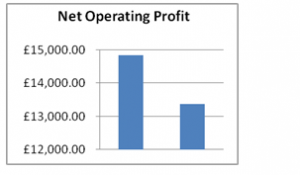

Figure 4: Net Operating Profit

(Source: Created by Researcher)

It is to be concern to management that the expected budget fail to attain actual budget as the difference in net operating income is observed by £1460. The management needs to focus on the expense which has increased. The fixed expenses such as insurance expense, facility rent, fuel expense has increased by total amount of £800 + £300 + £10, which is £1110. The Twin River Cafe needs to decrease the excessive fixed expenses by implying a good management team (Siahaan, 2018, p.52). It is also observed that the organization has a low sale quantity. The actual sale is lower than expected sale by 200 units of meal (Erlina and Muda, 2017, p.311). The management needs to focus on sale by implying advertisement. Increase of sale of meals will maximize profit as fixed expenses are constant (Ousama, Bybordi and Shreim, 2019, p.89). Budget control will enhance the organization’s performance and it also assists management to control financial expenses. It is advised to organization to maintain budget control to reduce expenses and enhance sales.

Based on the above report it can be concluded that budget control helps to maintain financial decision of organization and improve performance. It enhances an organization’s ability to maintain financial performance and rectifies errors as well. The Twin River Cafe has variances in expected budget and actual budget. The budget is important as the variances will help the management to take more precise decision in future. The budget is also a guideline, by following the guideline organization able to decrease expenses and increase profitability. It is also observed that the quality of meals and other operational activity is needed to be concerned by the management of The Twin River Cafe to increase the number of customers.

Alimoradi, S., 2016. An Investigation of the Impediments of Performance-Based Budgeting in the National Iranian Gas Company. International Business Management, 10(10), pp.1809-1816.

Ardini, L. and Dewi, N.H.U., 2017. Understanding Budget Reality in The Perspective of Symbolic Interactionism. INTERNATIONAL RESEARCH JOURNAL OF BUSINESS STUDIES, 9(2).

Banerjee, S., 2015. Contravention between NPV & IRR Due to Timing of Cash Flows: A Case of Capital Budgeting Decision of an Oil Refinery Company. American Journal of Theoretical and Applied Business, 1(2), pp.48-52.

Caperchione, E., Demirag, I. and Grossi, G., 2017, March. Public sector reforms and public private partnerships: Overview and research agenda. In Accounting Forum (Vol. 41, No. 1, pp. 1-7). Taylor & Francis.

Dokulil, J., 2016. Budgeting Process in the Business Environment. In Conference Proceedings DOKBAT (p. 111).

Erlina, A.S. and Muda, I., 2017. Antecedents of Budget Quality Empirical Evidence from Provincial Government In Indonesia. International Journal of Economic Research, 14(12), pp.301-312.

Gachoka, N., Aduda, J., Kaijage, E. and Okiro, K., 2018. The Moderating Effect of Organizational Characteristics on the Relationship Between Budgeting Process and Performance of Churches in Kenya. Journal of Finance and Investment Analysis, 7(2), pp.1-5.

Hong, Y. and Wu, H., 2019. Construction Modern Enterprise Budget Management System.

Lonardi, F., Ovrum, B.E., Dennehy, M.R. and Pipp, P.I., 2018, December. Agent based simulation marketing mix model for budget management in cosmetic industry. In Proceedings of the 2018 Winter Simulation Conference (pp. 4099-4100). IEEE Press.

Mutambatuwisi, F., Mapira, N., Madenyika, E.C. and Muzvidziwa, R.F., 2016. Effectiveness of Results Based Management as a Performance Management Tool Evidence from Small and Medium Enterprizes (SMEs) in Zimbabwe. International Journal of Trend in Research and Development, 3(1).

Naldi, M., Nicosia, G., Pacifici, A. and Pferschy, U., 2016. Maximin fairness in project budget allocation. Electronic Notes in Discrete Mathematics, 55, pp.65-68.

Ousama, A.A., Bybordi, N. and Shreim, O.S., 2019. Analysis of the Budgeting System: A Case Study of a Manufacturing Company. Asian Journal of Accounting Perspectives, 12(2), pp.82-100.

Rubin, I.S., 2019. The politics of public budgeting: Getting and spending, borrowing and balancing. CQ Press.

Samuels, J.A. and Sawers, K.M., 2017. SRS Educational Supply Company: An Instructional Budget Project. Issues in Accounting Education, 32(4), pp.51-59.

Siahaan, A.P.U., 2018. Good Corporate Governance Approach to the Budget Identification of Medan City Government.

Sze, C.M., In, L.W., Ngai, L. and Yan, O.W., 2015. Budget airline industry in hong kong. International Journal of Trade, Economics and Finance, 6(2), p.129.

Tan, W. and Ma, Z., 2019, January. The Establishment of Modern Enterprise Budget Based on ERP Control System: The Evidence from Dongfeng Yueda Kia. In 3rd International Seminar on Education Innovation and Economic Management (SEIEM 2018). Atlantis Press.

Ter Bogt, H.J., Van Helden, G.J. and Van Der Kolk, B., 2015. Challenging the NPM ideas about performance management: Selectivity and differentiation in outcome‐oriented performance budgeting. Financial Accountability & Management, 31(3), pp.287-315.

Wynen, J. and Verhoest, K., 2016. Internal performance-based steering in public sector organizations: Examining the effect of organizational autonomy and external result control. Public Performance & Management Review, 39(3), pp.535-559.

Zhao, Z., 2018. Case study of the role of third-party evaluators in performance-based budgeting reform at the local government level in China. Value for Money, p.299.

Zijlstra, T., 2016. On the mobility budget for company car users in Flanders.

| Months | July, 2018 | |||

| Details | Budget | Actual | Under/Over | |

| Budgeted meals quantity | 18,000.00 | 17,800.00 | 200.00 | |

| Income :- | ||||

| Revenue | £ 81,000.00 | £ 80,100.00 | £ 900.00 | |

| a) Total Income | £ 81,000.00 | £ 80,100.00 | £ 900.00 | |

| Expenses :- | ||||

| Raw material | £ 43,200.00 | £ 42,720.00 | £ 480.00 | |

| Wages and salaries | £ 10,600.00 | £ 10,540.00 | £ 60.00 | |

| Utilities | £ 3,300.00 | £ 3,290.00 | £ 10.00 | |

| Facility rent | £ 4,300.00 | £ 5,100.00 | -£ 800.00 | |

| Insurance | £ 2,300.00 | £ 2,600.00 | -£ 300.00 | |

| Fuel | £ 2,480.00 | £ 2,490.00 | -£ 10.00 | |

| b) Total Expenses | £ 66,180.00 | £ 66,740.00 | -£ 560.00 | |

| c) Net Operating Profit (a-b) | £ 14,820.00 | £ 13,360.00 | £ 1,460.00 | |

(Source: Created by Researcher)

| 1. Name of Customer? | Alex | Maria |

| 2. Age of Customer? | 22 | 25 |

| 3. Gender of Customer? | M | F |

| 4. How long he/she visiting The Twin Rivers Café? | 2 months | 3 months |

| 5. Is he/she satisfied with the quality of meal? | Yes | Moderate |

| 6. Which meal he/she likes most? | Cappuccino | Grilled Sandwich |

| 7. Cost effectiveness of meals in The Twin Rivers Café? | High | Average |

| 8. How much he/she likes accommodation of The Twin Rivers Café? | Very Good | Average |

| 9. How much he/she spend every time in The Twin Rivers Café? | 5 | 3 |

| 10. Why he/she takes meal in The Twin Rivers Café? | Location | Quality |

| 11. Have he/she seen advertisement of The Twin Rivers Café? | Yes | Yes |

| 12. How often he/she visit The Twin Rivers Café? | Twice a week | Once a month |

(Source: Created by Researcher)