- Posted on

- Unique Submission Team

RESEARCH ON FINANCIAL MARKET AND CAPITAL BUDGETING ANALYSIS 2020

Financial market is a place where securities, justice, agreement and money are exchanged. There are various kinds of financial market that do trading in millions or trillions every day.

It is a place where exchange of currencies takes place and it also provides security to their customers.

In financial market, the business focuses on developing many while reducing the possible risks and threats and allows customers to invest fund in the business.

It functions as a channel between the investor and the collection agency by exchange of money between them (Madura, J., 2020).

However, in the financial market, the investor buys stock from the stock market and commerce all the companies that are present in the stock market exchange.

With the help of financial market, it becomes easy for companies to transact funds between various investors and it takes less time in identifying desirable investors that are capable of investing money.

Moreover, capital budgeting refers to the technique of making decisions which are made by the organization in order to develop models that can elevate the capital of that particular organization.

These models can be efficient in developing strategies that can help an organization to build new organization and even help in expanding the sphere of an organization.

Capital budgeting is a process which allows an organization to make a prediction of the net capital that can be used and it also helps in predicting the time span of a project (Pilbeam, K., 2018).

In this assignment, basic principles of finance are discussed and research on three Australian financial markets has been discussed.

This assignment is divided into three parts where part 1 focuses on the fact finding on Australian financial market whereas part 2 focuses on the trading practices that are adopted by financial market and part3 concentrates the risk analysis of this project work.

PART 1 RESEARCH AND FACT FINDING OF AUSTRALIAN FINANCIAL MARKET

1.1 COMPARISION BETWEEN THREE ESSENTIAL TYPES OF BUSINESSES IN AUSTRALIA

| Criteria | Queen Victoria’s market | Fisher and Paykel Healthcare | Westpac Business bank |

| Owners of business | Jane Fenton Am (Chairman) Rob Adams Am (Director) |

Lewis Gradon (Director and CEO) | Lindsay Maxsted (Chairman) Peter King (CEO) |

| Level of difficulty in setting up the business | At the beginning it was difficult to set up the business but later the owner of the company solved all the problems. | With the emergence of technology and science the healthcare company was able to set up the business. | Previously the name of the company was Bank of New South Wales and difficulty level was medium. |

| Life of the business | It is an unlimited business | It is an unlimited business and the sphere of the business is enlarging | It is an unlimited business serving all around the world. |

| Liabilities of owner over the business debts | More than 6,000,000 | More than 4,000,000 | More than 8,000,000 |

| Legal status of the business | The business is legal | The healthcare business is legal | The business bank is legal |

| Level of difficulty in mobilizing fund | High | Medium | Medium |

| Level of difficulty in business transfer | Medium | Medium | Medium |

Table 1: Comparison between three essential businesses in Australia

1.2 ANALYSIS OF FIVE BASIC PRINCIPLE OF FINANCE

The financial market helps an organization in many ways and with the help of financial market it becomes easy for companies to transact funds between various investors and it takes less time in identifying desirable investors that are capable of investing money (Betz, F., 2018).

The financial market follows five basic principles and keeping these principles in mind the organization can easily mobilise funds within different companies. The five principles of finance are:

- One of the most important part or principle of finance is that Money Has a Time Value, which means that the value of money changes over the time. The value of money in the current time is likely to become much lesser in the future (De Haan et al, 2020). The value of money does not stay static or same, not only that, the value of money never increases much but the value decreases over the time. Thus, it can be said, that the major principle of finance highlights the one-way movability of money in terms of value.

For instance, in CNN Business, 8thMarch 2020, it was reported that there is a decrease in global markets where trillions of dollars are being erased in the market due to the outbreak of Corona Virus all around the world.

This caused a huge economy loss all around the world. The stock market is facing a huge loss and is curves are lowering.

The bear market is facing a fall of 20% however the finance market provides different story and the capitulation of US treasury notes has also faced loss however with the help of capital budgeting the organization are working hard to elevate the curves of Stock Market exchange.

The example shows the changes in value over the time in the market.

- Similarly, there is another principle is ‘Risk Return Trade off’. It has been observed that, when the higher probability of return is there the risk is also very high. Similarly, when higher probability of smaller return, the risk is also small (Kovalchuk, Y., 2020). The entire financial system is followed by the particular aspect.

For instance, in CNN business, 3rd September 2020, it was reported that the missile of United States has been destroyed by the straits of Taiwan which the government of China to face aggression.

The United States continued their process in the commitment given by Taiwan they announced six assurances that are related to the sale of arms of the United States.

They also mentioned that Taiwan will not force Beijing. Management of finances, it is referred as the flow of funds internally and it allows intermixing of the funds which can help in elevating the capital of the company.

It also helps in intermixing of debts and provides financial justification (Malenko, A., 2019). This principle also revolves around the fact that it gives values to the debts and also provides justice to the investors.

- Another major principle is that ‘Cashflow are the source of value’, according to th every idea, the cash that is transferred in an out of the organization is presented in the cashflow statement and therefore, it is the only way how the value of an organization can be realized in the proper order. (Batra et al, 2017). The cashflow indicates the value earned and the value that has been disposed. Therefore, the cash that flows through inflow and spend through outflow are considered as the main sources of income and asset of an organization.

For instance, in CNN Business, 27th February 2020, it was reported that most of the CEOs are under a huge pressure in order to make the worlds a better place, however, this duty is difficult for them and they are trying hard to accomplish this principle. The CEO and investors are facing a huge problem.

Moreover, change in climate is also affecting the economic state of the company as most of the company is facing challenges because of the outbreak of Corona virus and it is difficult for them to convince investors to invest funds in their company.

- Market Prices reflect information’ it is the fourth principle. It has been observed that assuming thar the market efficiency is there the prices of the products provides the information of the products and their features or value and quality. Hence, the pricing is the main indicator of the product details (Irons, R., 2019).Thus, it is again a very important principle of Finance.

For instance, in CNN Business, 19th March 2020, it was reported that business all over the world is facing a huge loss in the mobilisation of the funds.

Due to the outbreak of Corona Virus, most of the people do not have insurance and the mortality rate due to corona virus is very high. As reported by World Bank, 5% GDP can be abolished due to this pandemic.

- Last important principle of finance is ‘Individuals response to incentive’. In the market, each individual work in order to increase the profitability, both buyers and sellers. Hence, each of the has different types of reaction to provide. The reaction decides the level of incentive and their valuation in the market.

Part 2. Fact Finding of Australian financial market trading practices and regulations

2.1 Fact finding of the trading on ASX

Identify at least 5 types of information the public companies provide on the area of Previous Trading Day Announcement.

- One type of information that is provided by the public companies on the area of previous trading day announcement is the annual report for the stakeholders. In this information the activities of the company in the whole year is being outlined through a report. In this information the name of the directors of the company is also mentioned. What are the principle activities were also mentioned in this information. In short, the overview of the whole project is being written along with the summary of the resources. An explanation of the operations carried out throughout the year under that project is also provided. The financial status is also mentioned along with the declaration of the directors.

- Another type of information which is provided by the companies are cessation of being a substantial holder. There are some information which are included in this such as the details of the holder where the name of that holder along with the date at which he or she is ceased and when is the notice given are being mentioned, changes in the relevant interests, association changes, address and the directions.

- Form of proxy which is updated or the date of a meeting is another type of information provided by the public companies. The details of the proxy form and its replacement is mentioned by them in that information. It is given to the shareholders and voting for the original resolution and the replacement resolution is also mentioned. The shares, acts of corporation, conditions of the original resolution are mentioned and the details of the proxy form is also included in it. Details of the meeting like location time are provided.

- Another information is the suspension from official quotation. The description of it is included in this. Who will be suspended and on what date it will be done is provided under this information. The name and details of the person who issued it is also mentioned.

- The statements of finance and the report of the directors is another information which is provided by the public companies. The report of the finance for whole year is included in this information. The name of the directors is included in this information along with the principle activities. In the reports of the directors there are some factors which are included such as regulations of the environment, interests of the directors in the shares and options, statements of the directors, meetings, audited remuneration report etc(Safari, 2017).

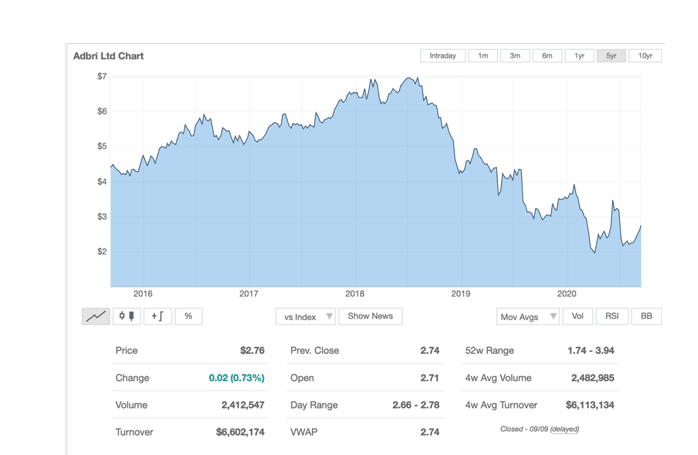

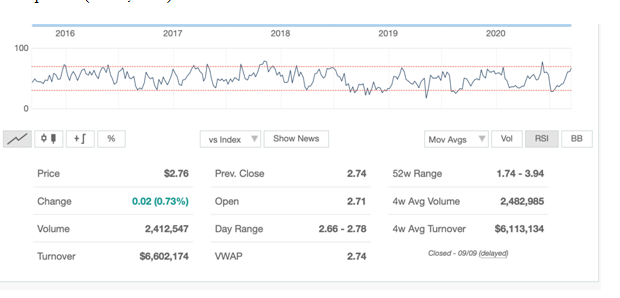

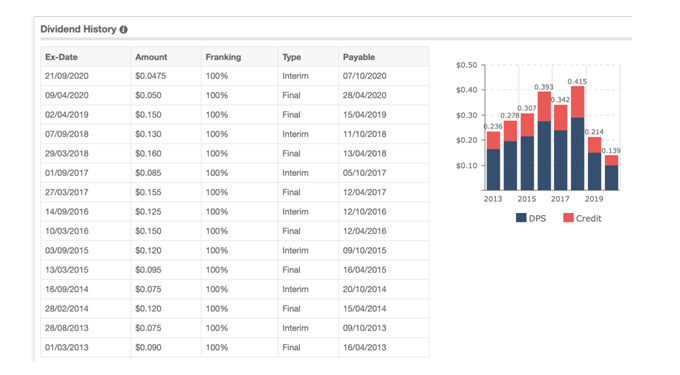

The concepts of ex-dividend date, record date, date payable, dividend franking and type of dividends by the companies listed on ASX.

To a share in the profits or earning of the company a person is being entitled as a shareholder. For rewarding the shareholders paying a dividend is one of the ways.

An important criterion for a large number of investors is observing if a company is able to pay dividends and what is the size of those dividends payed by the company.

twice a year dividend is being paid by the companies which are in the list of ASX and it is payed as interim dividend along with a dividend which is final. Companies have the allowance to pay the dividends more frequently. A special dividend maybe paid by the companies which is associated with a specific event.

The day after the announcement of the dividend by the company the data of dividend is commonly available.

To know about the last four payments of dividend the code of the company should be typed. Here those payments of dividends which are paid through cash are being displayed.

A percentage of the earnings of a company is the paid to be as amount of dividend and it is referred to as dividend payment ratio. Record date, date payable and ex dividend are included in each of this dividend.

Record date: – 5:00pm on the date on which the register of the share is closed by a company is considered to be the Record Date.

It is done because the company wanted to identify which shareholders are qualified for receiving the dividend which is current. In that date all the changes are done and finalised to the details of registration.

Ex-dividend date: –

One business day prior to the record date of the company the ex-dividend date is being considered.

Before the date of ex-dividend the shares should be purchased by the shareholders in order to be qualified for receiving the dividend. If anyhow it is missed the share owners in the previous will be qualified for the dividend.

The share price maybe increased when the date of ex-dividend is near and then it falls after the date.

Date payable: –

The date on which the payment of the dividend is being done by the company to the shareholders is considered to be as date payable(Shimeld et al., 2017).

7 types of trading reports listed in ASX 24 Reports

The seven types of trading reports are-

- End of the day market summary- in this report the amount of trading done in day or night near the date of trading is saved.

- Daily non-NTP report: in this report certain things are included such as registration time of exchange of physicals and block trade, for the previous day of trading the volume and price. At approximately 9:30 am according to Sydney time the data is updated regularly.

- Monthly trading statistics: in this report the statistics of trading report of Sydney and new Zealand monthly is being recorded which includes monthly market report and non traded volume report.

- Monthly traded EFP and BTF volumes: in this report the volume of EFP which is traded monthly by the companies are recorded in tabular format where the codes of the contract and the months are included.

- Historical price volatility data: in this report the data of volatility is recorded in tabular format which includes date of trading, code of commodity, month of expiry, year of expiry, days of expiry, strike, settlement which is underlying and option volatility.

- Record volumes: In this report volumes are being recorded which includes the description along with record date, record day volume, commodity etc. in a tabular format.

- Annual volumes: in this report certain data are being recorded in tabular format such as total electricity, renewal energy certificate etc, mainly it records the energy and environment and grains(Czekowski et al., 2019).

Types of calculators available on ASX website for the usage of investors and practitioners.

There are six types of calculators available on the website of ASX. Such as-

- ASX bond calculator- for calculating the prices of bonds and Exchange-traded Australian Government Bonds’ yield along with standard fixed interest bonds it is used.

- Options calculators: this is used to estimate the particular position of an option’s margin obligation, option prices that are theoretical, diagrams of plot payoff, models of various strategies and pricing comparison, the chance of an option’s early exercise etc.

- Interest rate futures and options calculators: used to calculate the products of new Zealand, ASX packs and bundles and also ASX 24 futures and options.

- Warrants calculator: used to calculate several warrants of equity

- Listing fee calculator: provide the guidance of the listing of equity of ASX

- SMSF calculators: by this calculator the super investors can see how various strategies will influence their income in future, history of performance for 40 years of the share market of Australia and also over the last two decades the charting of the major asset classes performance etc.

The questions you should ask your broker before you start trading?

The questions are-

- What is the style of investing should be?

- What type of manager of financial is needed?

- What are the certification of the manager?

- In which the adviser will be paid?

- Is the person showing professional attitude?

- Am I obtaining full and proper discloser of the important facts?

2.2. Fact Finding of financial market regulator in Australia

What are the ASIC roles?

the role of the ASIC is to regulate the services associated with the company and finance and also helps in enforcing the laws for the protection of the creditors, consumers as well as investors.

Who and what ASIC regulate?

ASIC regulates services of finance by monitoring the licence and services of finance of a business to give assurance that they are operating in an effective, fair as well as honest ways.

They also regulate the people associated with consumer credits such as banks, credit unions etc. the markets are also regulated by them.

the assessment of the financial markets which are authorised and are monitoring their obligations that are legal for operating fair as well as orderly and transparent markets(Kavame et al., 2020).

What are the powers of ASIC?

- The rules making for ensuring the markets for finance’s integrity

- Investigation of breaches in law which are suspected

- Banning people from the engagement in activities of credit or delivery of services of finanace.

- Seeking for penalties from the courts

- Issuing the notices for infringement associated with breaches in some laws

The steps they should consider to decide whether they should apply for that license?

- Reading the guidance based on the regime of credit licencing

- Determination of if I would like to engage in that activity

- Determination of the exemptions which could be applied to me(Ramsay and Webster, 2017).

PART 3 Risk Analysis and Project Evaluation

3.1 Scenario Analysis

After analysing the entire project it has been identified that there are certain risks that are associated with the project and its sells in the market.

However, looking at the project budget, per unit price and other important factors, the increase rate or the decrease rate in the costing it can be said that the organizational project is in a mild or a medium level of risk.

The Net Present Value of the product and the changed value does not make an outstanding change and therefore, it is likely that the probability of Risk is not extraordinary.

Batra, R. and Verma, S., 2017. Capital budgeting practices in Indian companies. IIMB Management Review, 29(1), pp.29-44.

Betz, F., 2018. Strategic Financial Markets–The Case of Securitization. In Strategic Business Models: Idealism and Realism in Strategy. Emerald Publishing Limited.

Czernkowski, R., Kean, S. and Lim, S., 2019. Impact of ASX corporate governance guidelines on sustainability reporting. Accounting Research Journal.

De Haan, J., Schoenmaker, D. and Wierts, P., 2020. Financial Markets and Institutions. Cambridge Books.

https://www.asx.com.au/prices/daily_monthly_reports.htm

Irons, R., 2019. The Fundamental Principles of Finance. Routledge.

Kavame Eroglu, Z.G. and Powell, K.E., 2020. Role and Effectiveness of ASIC Compared with the SEC: Shedding Light on Regulation and Enforcement in the United States and Australia.

Kovalchuk, Y., 2020. Determination of the features and basic principles of finance of railway transport in conditions of energy conservation. Technology audit and production reserves, 3(4 (53)), pp.22-27.

Madura, J., 2020. Financial markets & institutions. Cengage learning.

Malenko, A., 2019. Optimal dynamic capital budgeting. The Review of Economic Studies, 86(4), pp.1747-1778.

Pilbeam, K., 2018. Finance & financial markets. Macmillan International Higher Education.

Ramsay, I. and Webster, M., 2017. ASIC enforcement outcomes: trends and analysis. Company and Securities Law Journal, 35(5), pp.289-321.

Safari, M., 2017. Board and audit committee effectiveness in the post-ASX Corporate Governance Principles and Recommendations era. Managerial Finance.

Shimeld, S., Williams, B. and Shimeld, J., 2017. Diversity ASX corporate governance recommendations: a step towards change?. Sustainability Accounting, Management and Policy Journal.