Assignment Sample on Stock Market Prediction

INTRODUCTION

Many financial institutions, such as stock exchanges, create a ton of data and look for effective ways to extract important data about stocks and economies in order to resolve speculation options. Also, with easy access to stock data and information, many free financial investors around the world are associated with foresight costs to gain market openness and wealth. The problem stems from two related factors: There are a lot of stocks waiting, and there is a lot of hidden stock on the web, in the papers, in magazines, on the radio and on TV. How do financiers come close to deliberately choosing stocks to choose which shares they have and benefit from less risk? 1. Post-test motivation: the reason for this investigation is to determine whether the stocks are selected using a mix or combination of test methods, and then followed and controlled using an exchange process, surpassing Australian security exchanges. In particular, we may want to expand on the investigation to determine how far the Logistic Regression model can detect stock outages and help stock options, as other information mining processes, for example, CHAID, C5.0, and Neural Networks have indicated in. Guess (B) In this study, the following assumptions will be made:

H1: Shares selected in close proximity to the home route surpass Australian security exchanges.

H2: Shares selected using selected trees,

H3: Shares selected using neural organization intelligence.

H4: Shares selected using active models,

Australian security exchanges will have H1, H2, H3, and / or H4. This remaining paper shows our approach to evaluation, which goes hand in hand with a discussion of our investment opportunity and exchange policies. We wrap up our paper with an end-to-end test and a description of our test, just like the existing test guidelines for the future.

Objective:

Large volumes of historical data have been stored electronically in recent decades, and this volume is expected to grow significantly in the future. The purpose of this paper is to use a number of analytical methods to divide shares into two groups over the next 20 trading days: (1) stocks that could rise in price, and (2) stocks that could go down in price. To classify our shares as going up or down in price, we have used decision-making trees, neural networks, and declines. These stock forecasts have helped us to decide whether to buy stock or not.

LITERATURE REVIEW

A large number of pre-stock check-ups and stocks have been distributed. Return on offer can be expected in various European business sectors (e.g., UK, France and Germany). In the global arena, corporate account, and banking, the changes have been used most of the time. To make a high-end model of anticipating stock arrival profitably and effectively, depreciation was used as a consolidation device. The effectiveness of neural organization models, which are considered complex and useful in anticipated security exchanges, has been tested by scientists. According to the data test, the effective rate of application produces coefficients in all individual variations. The bursary was awarded to C5.0 and CHAID for a special photograph of the use of the two selected trees used in this study (CHAID and C5.0). According to available literature, there was almost no test using rational methods of anticipating stock options on Australian security exchanges. In this context, current research can provide useful information for investors, allowing them to make scientific investment decisions rather than intuition-based decisions. In Machine Studies, deciduous trees are used to build models for the division and regression of data mining and trading. The decision tree algorithm performs a series of repetitive actions before reaching the final result, and when these actions are built into the mirror, the visual is like a large tree, hence the name. The cutting tree is actually a flow that helps you make decisions. Let’s take a look at how Learning Machines use the same approach to make better decisions.

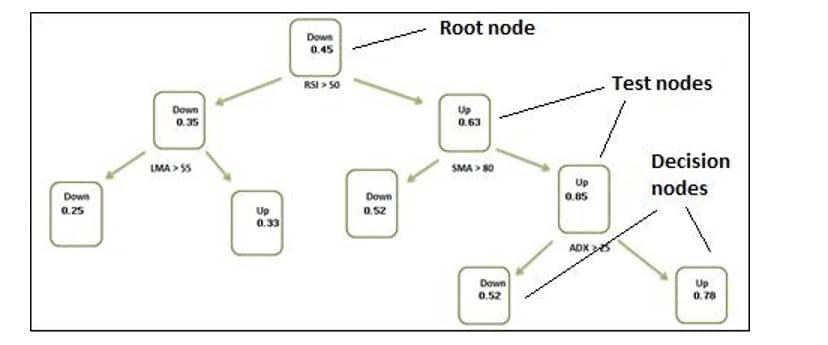

So, if the RSI of this stock was 39 years old on a given day, go to the right of the tree and check if the SMA is> 80, if so, go to the heading, “stock has 0.52 chances of a downturn.” nodes, test nodes, and decision-making areas form the structure of the decision tree (leaves). In the decision tree, the root node is the most important node. We start with RSI> 50 in the resolution tree above, so the RSI indicator is a root zone. You may be wondering why the RSI index value is 50 and not 34. That’s where learning is prepared, preparation. The tree study tree algorithm has found that the RSI of 50 resources in making decisions is more accurate than any other value. Following a root node, each test node separates data into subsets according to pre-set conditions. We have SMA> 80, LMA> 55, and ADX> 25 in the decision tree above (again, these numbers are product training). Data is categorized into test nodes based on those metrics. The leaf node is the final node in the management category. The leaf nodes in the decision tree diagram include the Up / Down category and the number of opportunities that indicate the potential for responsibility. The query asked in a node (e.g. RSI> 50) is considered ‘yes’ to the left of each location. If so, the algorithm wanders to the left side of the tree; if not, the algorithm wanders to the right.) According to the requirements set out, all the data is randomly separated from the roots of the decision tree down to the leaf.

Root nodes, test nodes, and decision-making areas form the structure of the decision tree (leaves). In the decision tree, the root node is the most important node. We start with RSI> 50 in the resolution tree above, so the RSI indicator is a root zone. You may be wondering why the RSI index value is 50 and not 34. The algorithm of the Learning Machine Algorithm has been able to understand that a 50-year-old RSI helps to make more informed decisions than any other value, which is where training is conducted.

Following a root node, each test node separates data into subsets according to pre-set conditions. SMA> 80, LMA> 55, and ADX> 25 are all in the decision tree above (and these numbers are the result of training). Data is divided into test nodes based on those metrics.

The leaf node is the last circle in the series. The leaf nodes in the decision tree diagram include the Up / Down category and the number of opportunities that indicate the potential qualification. The query asked in a location (e.g. RSI> 50) is called ‘yes’ to the left of the node. If so, the algorithm wanders to the left side of the tree; if not, it will turn right.)

As a result, the entire database is categorized by navigating under the decision tree from the root zone to the leaf, depending on the specified conditions (Rossi, 2018).

Decision Tree Inducer

The decision tree trimmer forms the decision tree (also called splitting). ID3, C4.5, CART, CHAID, QUEST, CRUISE, and other decision tree recommendations are just a few examples. (More details on these inducers can be found here and there.) The algorithm that automatically creates a decision tree from a given (training) database is known as the decision tree inducer. The inducer’s purpose for a decision-making drug is usually to create the right decision-making tree based on a given task. The goal of the goal may be to reduce the number of nodes in the decision tree to reduce the difficulty. Minimize the most common error in another example (or get accurate results).

Unless we have mentioned that the inducer creates a decision tree automatically, the decision tree inducer actually follows a certain process. Generally, decision-makers use one of two methods. The upper bouts featured two cutaways, for easier access to the higher frets (Choudhry and Garg, 2018).

In this analysis, five stock options were used. One personal trading strategy, one Decision Tree-based (CHAID; C5.0) one, Neural Network-based, and one Logistic Regression-based. Each selection strategy has selected six stocks, each stock receiving an investment of ten thousand dollars in the market. For all strategies, five variables were used to maintain the corresponding input:

- Return on Assets.

- Return on Equity

- Growth this year,

- Analysts opinion

- Price

Flowchart

Description of the High Lower Path

The inducer produces a decision tree in a high, low, repetitive way using the high-down method. To better understand this downward, repetitive approach, let’s use the technical indicators we have already developed.

The RSI, SMA, LMA, and ADX indicators were among the technical indicators we developed. The algorithm of our decision tree considers these metrics as symbols. Which of these marks (attributes) will the inducer use as the first place? What will happen to the remaining signs? The inducer determines all this using a dividing method. The separating function determines the best quality to start with and classifies the training database using those parameters (e.g. information gain, Gini index). Here are some tools to help you learn more about the benefits of information and the Gini index. The inducer algorithm separates the training data using the intuitive performance result of the input attribute in each iteration. Each node continues to divide the training set into sub-subsets after selecting an acceptable partition, until no further separation is required or the configuration condition is met. To minimize splitting errors, the tree is pruned after it has been completely rebuilt using certain pruning rules (Madge and Bhatt, 2017).

This is how a decision-making drug, which can be used in machine learning to predict prices. In a future post, we’ll show you how to build a decision tree in Python and look at machine learning models that use decision trees.

METHODOLOGY

Let’s get to the point: we want to use cutting-edge trees in machine learning to predict which way your stock will go. Therefore, we will need stock history data. Consider the table below, which shows a sample of the stock database. The database includes Free, Large, Low, Near, and Length (OHLCV) indicators. Using Yahoo Finance or Google Finance, you can download historical data for any stock(Patel et al., 2015).

We’ll do this job in R-programming language, so make sure you have the required software installed on your Mac or PC. Here is a resource to help you. Here’s the code for getting this data to your computer.

Using these technical indicators, we want to predict daily changes (up / down). For this database, we will use the tree-learning decision algorithm to do this. To begin with, we must divide our database into two parts: the training database and the test database. The algorithm learns stock movements from training data and makes those predictions, called “knowledge gains.” Then, when the training is complete, we use it to make stock price estimates on the test database. Supervised learning is the name given to this Learning Machine form. This is the code for implementing these steps in practice. The operation of the training database can be set in the form of a tree structure, as shown below.

DATA ANALYSIS

We then selected all industrial stocks that exceeded the Australian Ordinary Index and became increasingly popular in the market. There has been a total of 34 shares in this category. The top six stocks are then selected based on the following criteria:

- Return to Equity (ROE)> 15%,

- Return to Inheritance (ROA)> 10%

- Analysts’ assessment <3

- Current annual growth gauge> 20%

- Pure Industrial Factory

Therefore, we have selected six offers in all of our approaches. Contributions are given responsibilities based on key values, value, opinion of the examiner, and levels of development, and the value of all instruments approaches one another (Patel et al., 2015). At that time we evaluated our allocation from 1 to 6, then 1 was the most recommended score and 6 was the least (e.g., ROE decreased). The stock ratio and measured supply determines the final focus. Considering that when the school is down, it is almost certain that the stock will benefit. Of the 55 machine stocks, we used the C5.0 option set with five levels of information. The key metaphor is ‘value.’ The authorized rule is called ‘price> 1.05’. Similarly, in this portfolio, six special offers have been selected with the highest potential for C5.0 inflammation and to meet these criteria carefully. In 55 modern cells, we used the CHAID selection process with five levels of information. The rating was just as important as “progress this year,” and the law made “progress this year> 13.9 percent.” Using CHAID probability estimates, six shares with a high potential for inflammation were selected for this portfolio. Of the 55 machine stocks, we used the Neural Network with five levels of information. The main similarities were the inspector’s view, followed by “progress this year,” “costs,” and “discount” and “reimbursement for resources,” all of which were equally important. Therefore, using the estimates of neural organization planning opportunities, six offers are more likely to increase the selected costs of this portfolio. In 55 machine stocks, we used a Logistic Regression with five levels of information (Nabipour et al., 2018). Three ratings were basic. The most true myth is ‘return on value,’ followed by ‘cost,’ and ‘progress this year.’ In this portfolio, six stocks have the most significant cost consolidation measures to build their chosen costs.

FUTURE WORK

Many ways to find the best model for predicting stock prices can be included in future studies. We have used shares from the Industrial Sector, but it will be important to expand our research to see if our stock options and trading strategy will work in other industries. Another interesting idea we are exploring is to develop an application tool that integrates our stock collection strategy and trading strategy. Finally, our trading system has a maximum portfolio limit of 10% and an exit strategy if the portfolio loses 5% or more. Alternative trading methods can be considered.

REFERENCES

Choudhry, R. and Garg, K., 2018. A hybrid machine learning system for stock market forecasting. World Academy of Science, Engineering and Technology, 39(3), pp.315-318.

Madge, S. and Bhatt, S., 2017. Predicting stock price direction using support vector machines. Independent work report spring, 45.

Nabipour, M., Nayyeri, P., Jabani, H., Shahab, S. and Mosavi, A., 2020. Predicting Stock Market Trends Using Machine Learning and Deep Learning Algorithms Via Continuous and Binary Data; a Comparative Analysis. IEEE Access, 8, pp.150199-150212.

Patel, J., Shah, S., Thakkar, P. and Kotecha, K., 2015. Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert systems with applications, 42(1), pp.259-268.

Rossi, A.G., 2018. Predicting stock market returns with machine learning. Georgetown University.

Know more about UniqueSubmission’s other writing services: