STRATEGY MANAGEMENT

Executive summary

This report sheds light on the merger of the two banks, further, this report shows that in case the merger happens then this will also augment market share of the banks. In addition, it can be affirmed that this has an important part in enhancing the market shares of the companies. This also helps them in achieving the goals of the project. The layoff by the managers is 20% and the layoff by the employees 10%. The SB bank is focusing on the insurance sector and NB bank is focusing on the banking transactions. Thus the venture manager has to focus on the communication plan in order to improve the satisfaction of the stakeholders.

In order to augment the share in the market and for stimulating market growth mergers and acquisition is done in the financial and banking industry. In the modern era, the mergers and acquisition of corporate companies have different aspects. In addition, it can be affirmed that this has an important part in enhancing the market shares of the companies. On the other hand, it can be affirmed this situation can also boost up the number of customers in the market. Apart from this it can also improve the service of the organization. The objective of maximization of wealth the companies, they keep evaluating through the merger and acquisitions.

The venture scope helps the venture manager in meeting the goals of the project.

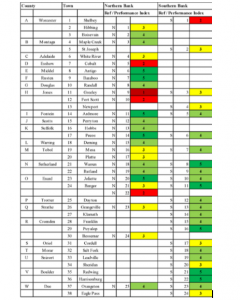

Figure 1: Venture objectives and key decisions

The APM focuses on the importance of the venture and also the goals of the project. In addition, it can be affirmed that in case the shareholders augment the investment in the venture then this will also augment the return on investment of the project.

Percentage of Managers lay off

In addition, the layoff by the managers is 20%, in this case, both the banks have decided for the20 % lay off for the managers. In other words, it can be affirmed that this will have no impact on the financial status on a long term basis (Aragonés-Beltrán et al. 2017).

Percentage of Employees lay off

The Northern and Southern bank has decided for the 10% layoff for the employees. On the other hand, it can be affirmed that this will not show an impact on the structure of the salary of the Northern and Southern Bank.

Human Resource Practices

Retain: The two banks Northern and Southern Bank have decided that they will retain their business. This will also enable them to retain efficient employees of the banks.

Rationalize: The rules and regulations will be applicable to the employees of the banks.

Replace: The business policies of the banks will be exchanged in order to complete the venture successfully. In this case, the business policies of the Southern bank (SB) are used by the business policy of the Northern bank.

Retain: The branches of both the banks are retained, before the merging; the Northern bank branches are more than the Southern bank which will change after the merging.

Rationalize: The best-suited branches are retained in every region of the country for maintaining the geographical coverage for the target audience

Close: In order to get the target audience the branches of SB are closed, in case there is a northern branch the Southern branch needs to be closed which will violate the business ethics.

Product Portfolios

Retain: The products of both the banks are the same from the previous ones after merging. The products that Northern banks occupy are credentials and mutual funds. On the other hand, Southern bank has its impression on the insurance sector for improving their business growth.

Rationalize: From the entire product the best breed products are selected and offered according to the company policies

Replace: Southern bank products are replaced.

Loan Approval Processes

Retain: Both the loan approval process is considered and the Southern bank policies are preserved.

Rationalize: New processes are merged for the harmony of the two banks.

Replace: The Southern loan approval process is replaced with the Northern one IT Systems

Retain: Both the system will apply autonomously for the advancement of the customer service.

Rationalize: The Southern system needs to be replaced with the Northern system for a better outcome. New protocols are enhanced for the unified system that can regulate the business growth of the organization.

Replace: The Southern database is formatted with the policies of the Northern bank.

Bank Name

Retain: Both the two banks have maintained their brand, signage, and names for maintaining the different business activities

NS Bank: Both the two banks have renamed and all the branches also which will make ease for the target audience.

Northern: All the Southern branches are rebranded with the Northern bank for effective business growth.

Period for Implementation of Integration Decisions

The integration decision period will take 6 months for the final completion.

Financial impact

The merger of the banks has a great impact on the financials of banks, in case the number branches augment then this will also augment the cost of the banks. Apart from this, it can be affirmed that in case the number of branches enhances then this will also augment the number of customers of the banks. This in turn also has impact profitability of the organization.

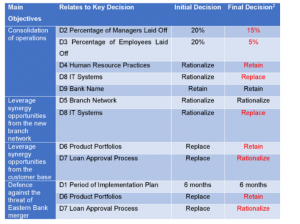

Figure 2: Cost

The revenue of the banks also enhanced by 17 million, thus, this signifies that as the number of branches is increasing then this will also augment the number of customers, this, in turn, will also augment the revenue of the company.

The venture governance helps the venture manager to manage the venture perfectly. The proper venture governance provides the roles and responsibilities to the venture management team. In addition, this also has an impact on the outcome of the project, in order to improve the outcome of the project; the venture manager has to implement the perfect strategy. In this case, the Northern Bank (NB) and Southern Bank (SB) merge. This situation of the companies enhances the market share of the banks. In other words, this also improves the service of the bank, this will also help them to attract more customers towards them, this, in turn, will also have an impact on the revenue of the banks. On the contrary, in this case, the goals and the objectives of the venture were not clear and this also has an impact on the outcome of the project. On the other hand, according to Sunder (2016), it can be affirmed that every venture has different requirements and goals that lead the venture to success. In this case, the venture team should have to be clear about their roles. Further, it can be affirmed that this venture has analyzed the micro and macro environment of both the banks that have an impact on the strategic implementation of the project.

In other words, in order to improve the outcome of the project, they have to develop the relationship between the stakeholders of the project. In this case, it can be affirmed that the perfect venture governance gives a clear idea about the roles of the venture management team. Further in order to get a better outcome from the venture manager will have to improve the communication between the stakeholders. The initial business plan established a communication plan that will help them to improve the efficiency of the project. In case the relationship between the stakeholders improves then this will have n impact on the outcome of the venture (Isa et al. 2018). The evaluation of the venture governance framework can be get benefitted through the following framework. As affirmed by Andersen (2016) this also allows accurate feedback from the venture management team and also from the other stakeholders.

The engagement of the stakeholders in the practice of interacting with the people who are involved in the project, moreover, the engagement of the stakeholders enhances the overall benefit of the project, this, in turn, also has an impact on the profitability of the company. In this case, both companies are looking for the mergers of the two banks. In doing so they have to involve the shareholders of the project, as this situation will also augment the investment of the banks, on the other hand according to Ferretti, (2016) in order to improve the service of the banks they have to involve the employees of the banks that will help them in improving the service of the organization. In addition, it can be affirmed that the success of the venture also depends on the view of the stakeholders of the project. In this case, it can be seen that the manager is 20% and the employees of the business are 10% responsible for the project. For example, Johnson is the most important stakeholder that has an impact on the satisfaction of the stakeholders.

In order to improve the outcome of the project, they have to improve the satisfaction of the stakeholders. In addition in case, the stakeholders of the business are satisfied then this will augment the efficiency of the venture team. Further, in order to improve the satisfaction of the stakeholders, they have to improve the communication between the employees. In case the communication between the employees improves then this will also improve the relationship between the stakeholders of the organization.

In other words, according to Mok and Shen (2016) it can be affirmed that in order to improve the outcome of the venture they have to keep the focus on the goals of the project. In case the venture management team lost the focus from the outcome of the venture then that will have an impact on the outcome of the project. On the other hand according to Chung and Crawford (2016) in case the venture management team is able to keep a focus on the goals of the venture then that will augment the satisfaction level of the stakeholders.

In addition, this will also have an impact on the outcome of the project. Furthermore, it can be affirmed that the venture team should take suggestions and reviews from the team then this will also help them in enhancing the efficiency of the team. In case the efficiency of the venture management team decreases then this will have an impact on the outcome of the project. Therefore, it can be affirmed that in case the number of branches enhances then this will also improve the service of the organization.

3.3 Stakeholder’s communication

The stakeholder’s communication is an important thing, in order to improve the relationship between the stakeholders they have to improve the communication between. In improving the communication between the employees they have to implement the perfect strategy that will have an impact on the profitability of the organization. For example, in case the communication between the venture manager and the team members improves then this will have an impact on the efficiency of the project. On the other hand, according to Deglane et al. (2017), it can be affirmed that every venture has different requirements and goals that lead the venture to success. In this case, the venture team will have to be clear about their roles, further, it can be affirmed that this venture has analyzed the micro and the macro environment of both the banks that have an impact on the strategic implementation of the project. In other words, in order to improve the outcome of the project, they have to develop the relationship between the stakeholders of the project. In this case, it can be affirmed that the perfect venture governance gives a clear idea about the roles of the venture management team. Thus in order to improve the communication between, the employees and the stakeholders, they have to improve the venture governance.

The venture manager should have to follow the Venture governance Framework; this will help them to establish a communication plan between the venture management team. This in turn also has an impact on the outcome of the project, in case the communication between the employees enhances then this will also augment the relationship between the employees of the organization. This will smoothen the process of merger between the companies, in other words, this will also augment the number of branches of the bank. This will also augment the number of customers of the company as well as this will also boost up the market share of the banks. Apart from this, it can be affirmed that the venture manager should have to focus on improving communication between the stakeholders.

In case the communication between the employees enhances then this will also improve the relationship between the employees. This in turn also has an impact on the outcome of the project. The venture manager also has to engage the stakeholders in the discussions this will augment the satisfaction of the stakeholders. Apart from this if the service of the bank enhances then this will also have an impact on the satisfaction of the customers, thus in case, the satisfaction of the customer enhances then this will also leave an impact on the profitability of the banks. In addition, it can be affirmed that they also have to improve the frequency of the communication, which in turn also has an impact on the satisfaction of the employees.

| Lesson learned | Recommendation |

| Defining governance framework and the associated roles and its importance in the success and the failure of the venture | The framework that is available in the venture is AMP (2018), this is used for establishing, maintaining and also execution of the project. In addition, it can be affirmed that everyone in the venture should have a clear knowledge about their roles in the project. In case they have a clear view of the venture then this will augment the efficiency of the project. This, in turn, will also have an impact on the outcome of the project. |

| Effective communication | In order to complete the merger of the two banks, they should have good communication between them. In case the communication between the stakeholders is good then this will augment the relationship between the stakeholders. This, in turn, will also have an impact on the completion of the project. In other words, this will also augment the efficiency of the venture team which will enable them to properly execute them with proper planning. |

| The HR department should have to play an important role in hiring workforce. | In case the HR department for the bank is able to hire efficient employees then this will also enable them to hire efficient employees. In case they are able to hire efficient employees for the business then this will also improve the merger process. This, in turn, will have an impact on the outcome of the project. Thus it can be affirmed that they need to hire efficient employees. |

| Review of the project | The venture manager should have to review the project. In case the venture management team lost its focus from the goals then this will also decrease the efficiency of the venture team and then it will lead to a failure of the project. On the other hand in case the venture manager takes review from the stakeholders then this will enable them to improve the process of the project. In addition, in order to improve the venture further, they can take suggestions from the team members. This situation will improve the relationships between the venture manager and the team members. This, in turn, will also have an impact on the result of the project. |

| The stakeholders should have to expert in taking key decisions. | The decision of stakeholders should be reviewed this will enable them to augment the efficiency of the team. |

Based on the above study it can be depicted that the venture manager has to focus on the efficiency of the team members. In addition, it can be affirmed that in case the efficiency of the team enhances then this will have an impact on the outcome of the project. Apart from this, it can be affirmed that the venture manager should have to engage the stakeholders in the venture this will enable them to boost up the satisfaction of the stakeholders. Apart from this in case, the two banks merge then this will also augment the number of customers of the banks. In addition, this situation will also augment the market share of the banks. Henceforth the HR department of the business also has to hire efficiency employees. In case they are able to hire efficient employees for the business then this situation will also improve the efficiency of the venture team and the venture manager also have to train the employees, which will help them in enhancing productivity. The stakeholders should have to be able to determine the key decisions regarding the project. This, in turn, will also have an impression on the project. Furthermore, the reviewed framework has knowledge about the communication strategy between the stakeholders. In case the communication between the stakeholders enhances then this situation will also have an impact relationship between the stakeholders of the project. In case the relationship between the stakeholders enhances then this situation will also augment the efficiency of the stakeholders of the project.

Andersen, E.S., 2016. Do venturemanagers have different perspectives on venturemanagement?. International Journal of VentureManagement, 34(1), pp.58-65.

Aragonés-Beltrán, P., García-Melón, M. and Montesinos-Valera, J., 2017. How to assess stakeholders’ influence in venturemanagement? A proposal based on the Analytic Network Process. International journal of venturemanagement, 35(3), pp.451-462.

Chung, K.S.K. and Crawford, L., 2016. The role of social networks theory and methodology for venturestakeholder management. Procedia-Social and Behavioral Sciences, 226, pp.372-380.

Deglane, K.C.B., da Costa Loures, L.E.V., Silva, R.G.A., de Souza Andrade, H. and Silva, M.B., 2017. Stakeholders analysis in complexprojects. International Journal of Humanities and Social Science Invention, 6(9), pp.73-81.

Ferretti, V., 2016. From stakeholders analysis to cognitive mapping and Multi-Attribute Value Theory: An integrated approach for policy support. European Journal of Operational Research, 253(2), pp.524-541.

Isa, N.A.M., Hamid, N.A. and Leong, T.P., 2018. A Stakeholder Analysis of the KLIA2 Airport Terminal Project. Asian Journal of Behavioural Studies, 3(13), pp.1-7.

Mäenpää, H., Kojo, T., Munezero, M., Fagerholm, F., Kilamo, T., Nurminen, M. and Männistö, T., 2016, November. Supporting management of hybrid OSS communities-A stakeholder analysis approach. In International Conference on Product-Focused Software Process Improvement (pp. 102-108). Springer, Cham.

Mok, M.K. and Shen, G.Q., 2016. A network-theory based model for stakeholder analysis in major construction projects. Procedia engineering, 164, pp.292-298.

Sunder M, V., 2016. Lean Six Sigma venturemanagement–a stakeholder management perspective. The TQM Journal, 28(1), pp.132-150.

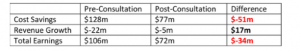

Appendix 1: NB and SB branch network and performance index