TERM 3 2019 ASSIGNMENT: BANKING & FINANCE

Globalization in the financial market this opened extended the business of the financial institutions.

These organizations help the institutions in raising funds; this can be done through the foreign currency convertible bonds. These bonds are mainly equity-linked debt securities.

Apart from this, it can be stated that this study will also give an idea about the foreign bonds liabilities of the big four banks in Australia and the other two small banks in the country.

Henceforth, this will also give a brief discussion about the annual report of the banks in Australia and its market.

Choice of the source of the funds

The offer of short borrowings decreases the cost and also reduces the idle capital of the banks.

On the other hand according to Atkin & Cheung, (2017), at the same time the long term borrowings also necessary for the banks, this equality in the equity of capital depicts an important part in gathering funds in the corporate sector.

There are some factors that can have an impact on utilizing the funds of the banks.

Cost:

As stated by Black et al, (2017), the cost can be specified into two types the cost of obtaining the funds and the cost of utilizing the funds, these two sources are used by the organization in order to determine the cost of the company.

Financial strength:

In case the international funds of the bank enhance then this will also strengthen the financial condition of the bank. This in turn also has an impact on the financial structure of the banks.

The inflow of foreign capital in the country has improved the economic condition of the country. As a result of that, the national saving of the country has also increased significantly.

The saving in the Australian economy is 24% of the GDP of the country, whereas investment is 28% of the total GDP of the country.

In addition, it can be stated that foreign investors have enhanced the investment in the country this in turn also have an impact on the growth of the country. According to Bell & Hindmoor, (2019), it can be stated that as the investment in a foreign country has increased this situation has also strengthened the economic condition of the banks. In case the investment in the country is increasing, this situation will also enhance the profitability of the banks.

In the year 2010, the funding in the domestic financial market has increased by a significant amount. As a result of that they have also decreased the offshore funding and as the price of the offshore funding have increased very much.

From the year 2012, the private financial institutions have enhanced their offshore borrowings of the money. They focused more on offshore marketing rather than domestic capital markets.

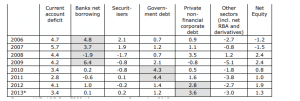

Figure 1: Current account funding

(Source: Bell & Hindmoor, 2019)

The difference between loans and deposits have become small, this situation has also decreased the demand for offshore demand.

The commonwealth bank is expanding its business in order to gain the market from the other countries.

In this case, it can be seen that in the case in order to expand the business of the banks they are taking funds from other countries like India, Sri Lanka, Mauritius and Malta have funded the bank with $5 million (commbank.com.au, 2019). This trade facility of the bank is named as the Commonwealth Small States Trade Finance Facility.

In this case, the Commonwealth Secretariat acts as the guarantor on the loans that also help to develop sustainable economic and trade conditions of the country.

In addition, this also plays an important role in achieving the goals of the country. In addition, it can be stated that this also helps the organization in expanding their business in other countries. Apart from this, they are also expanding the business of the bank, this in turn also has an impact on the profitability of the bank.

In this case, it can be seen that these four big banks have an impact on the Australian economy.

They play an important role in attracting foreign investors towards the country. In case the international source of fund enhances then this will have an impact on the profitability of the banks.

According to Cheung, (2017), this situation also helps in expanding the business of the bank. This in turn also has an impact on the business of the banks.

As the investment in the banks enhances then this will also enhance the loan amount which will also have an impact on the economy of the country.

However, in the smaller banks, this will also have an impact on their business. This also depicts an important role in enhancing the business of smaller banks, this in turn also has an impact on the profitability of the smaller banks.

Comparison with the four banks with the small banks

In this case, it can be seen that the four banks have an impact on attracting international funds towards them.

In addition, it can be stated that in case the big banks are able to attract more funds then this, in turn, will also have an impact on the investment. This also signifies that the savings in the country are increasing. In addition, it can be seen that the ANZ bank is focusing more on domestic funds to expect international funds (anz.com.au, 2019).

This, in turn, will also leave an impact on the profitability of the organization. In addition, it can be stated that the foreign currency liability of the bank is increasing than the previous year.

This also leaves an impact on the profitability of the organization. Furthermore, in the case of smaller banks, it can be stated that they mainly focus on the domestic market, this situation of the banks decreases the profitability of the organization, this in turn also leaves an impact on the profitability of the banks.

Apart from this in case, the smaller banks will be able to focus on the international fund then this will also enhance the profitability of the smaller banks.

This in turn also enhances the foreign currency liabilities of the banks.

The Global Financial Crisis (GFC) mainly refers to the period of extreme stress within the global financial markets along with the banking system between the mid of 2007 and early 2009.

There is a wide range of risk which is associated with the international funds during the pre and the post periods.

It can be observed that during the post-crisis operating environment for a bank there was low inflation on some of the large advanced economies.

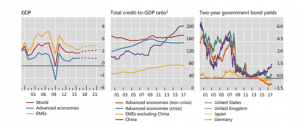

Figure 2: Economic growth, credit, and interest rates

(Source: bis.org, 2019)

From the above graphs, it can be seen that the prolonged private sectors have weighed in terms of aggregate investment as well as credit growth.

Moreover, it can be observed that benchmark nominal interest rates have seen to be historic laws in some of the cases while reaching towards the negative territory.

However, central banks seem to resort in some of the highly expansionary unconventional and conventional monetary policies which include the considerable expansion of the balance sheet.

In addition in the center figure of 1, it can be observed that the private sector credit has continued for expanding the EMEs, despite behaving some slow economic growth over the recent years of the large EMEs.

Apart from this, it can also be seen that there is an increase in the quality and quantity of capital through sticker risk-weighted requirements. Moreover, it is also found of international prudential regulations of liquidity risk with the centerpiece being existed of two quantitative instruments.

During the period of 2007 to 2013, most of the banks within the UK faced some of the hard times as their own transformation were in several dimensions.

It can be observed in most of the banks there is a crisis for not maintaining adequate liquidity as well as some of the capital for opting up with the macro-financial condition and high extensive financial risk within the banking sectors.

It can be observed due to the presence of this risk there is an enhancement of the resilience for adverse shocks in terms of making a strong capital position.

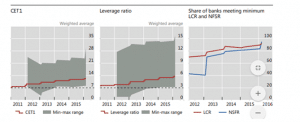

Hence, it can be seen during the end of the year 2016, all the big banks within the BCBS’s global monitoring sample tried o met with their fully phased in the Basel III target CET1 regulatory within the capital rations.

In addition to this, it also includes the G-SIB ratio surcharge where everything is relevant and it is widely shown in figure 2 left panels.

Figure 2: Large banks’ fully phased-in Basel II regulatory ratios

(Source: bis.org, 2019)

Apart from this, it also highlighted the issue of policy and regulations errors within the banks and it results in the old complex and opaque MBS to the investors.

It is also seen that due to the high amount if crises the banks did not even realize the high rate of bad loans which results in the spread of mortgage losses (westpac.com.au, 2019).

Moreover, it also results in the high rate of borrowing by the banks along with the investors which tend the bank to expand their lending and the purchasing product.

In this case, big banks focus more on international funds rather than the domestic market.

In addition, it can be seen that in order to enhance the business of the bank the ANZ bank is also focusing on the domestic market. This situation enhances the profitability of the bank.

Apart from this, it can be stated the smaller banks focus on the domestic market rather than foreign funds.

This situation of the banks decreases the profitability of the smaller banks, whereas the revenue of the big banks is more than the smaller banks.

This also decreases the foreign currency liability for the smaller banks; however, this enhances the foreign currency liability for the larger banks. For example, the commonwealth bank is expanding its business in order to gain the market from other countries.

In this case, it can be seen that in the case in order to expand the business of the banks they are taking funds from other countries like India, Sri Lanka, Mauritius and Malta have funded the bank with $5 million (commbank.com.au, 2019).

This situation signifies that in the Common Wealth bank plays an important role in attracting foreign funds towards this in turn also enhances the business of the banks.

This situation in the market also enhances the revenue of the bank. In case the revenue of the bank enhances then this will also enhance the profitability of the big banks.

However, the smaller banks also have to pay attention to international funds, which will help them in enhancing the profitability of the banks (heritage.com.au, 2019).

This also plays an important role in enhancing the number of customers of the banks. In case the number of the customer of the banks enhances then this will also enhance the revenue of the bank.

Therefore, it can be stated that the banks have to pay special attention to enhancing the profitability of the organization.

Apart from this, it can be stated that this also enhances the domestic saving rate of the country, in case the domestic savings rate of the country enhances then this will also have an impact on the domestic rate of investment.

This, in turn, will also leave an impact on the profitability of the company.

From the above study, it can be recommended that the four banks of Australia should have to focus on enhancing the business of the banks.

Apart from this, it can be stated in case the international source of funds enhances then this situation will also enhance the amount of investment in the country.

This in turn also has an impact on the business of the banks. In addition, it can be observed that ANZ bank has focused more on enhancing the investment in the domestic market rather than the foreign market.

In case the bank enhances the investment in the domestic market then this situation can also have an impact on the profitability of the bank, this, in turn, will also have an impact on the economy of the country.

Apart from this, it can be stated that this also enhances the domestic saving rate of the country, in case the domestic savings rate of the country enhances then this will also have an impact on the domestic rate of investment.

This, in turn, will also leave an impact on the profitability of the company. On the other hand, it can be depicted that in case the foreign investment rate enhances in the country then this will also enhance the currency’s value of the country, which will have an impact on the profitability of the company.

Furthermore, the Commonwealth Bank is focusing more on international funds. In case the source of the international fund enhances then this will also enhance the trade opportunities for the country, which will also leave an impact on the economy of the country.

Based on the above study it can be depicted that the four big banks in Australia will have to play an important role in enhancing the international source of the fund.

Apart from this, it can be depicted that the big four banks are aiming to enhance the international source of the fund this in turn also has an impact on the profitability of the banks. In addition, this also leaves an impact on the economy of the country.

In addition, it can be stated that ANZ bank is focusing more on the domestic market rather than the international source of funds.

This situation can reduce the profitability of the bank, apart from this it can be stated that this can also leave an impact on the economy of the country.

This study gives an idea about the situation of the economy after the global financial crisis; this situation has an impact on the profitability of the banks. This situation has decreased the flow of international funds, which in turn will also have an impact on the profitability of the organization.

In case the flow of international funds decreases then this will have no impact on the profitability of the smaller banks.

As the smaller banks focus more on the domestic market, on the other hand, it can be depicted that the global financial crisis also has an impact on the profitability of the smaller banks as this has decreased the saving of the domestic people, this in turn also has an impact on the investment of the country.

anz.com.au, (2019), about the company Retrieved from: https://www.anz.com.au/personal/ [Retrieved on: 2.01.2020]

Atkin, T., & Cheung, B. (2017). How Have Australian Banks Responded to Tighter Capital and Liquidity Requirements?. RBA Bulletin, June, 41-50. Retrieved from: http://www.rba.gov.au/publications/bulletin/2017/jun/pdf/bu-0617-reserve-bank-bulletin.pdf#page=44 [Retrieved on: 2.01.2020]

Bell, S., & Hindmoor, A. (2019). Avoiding the Global Financial Crisis in Australia: A policy success?. Successful Public Policy, 279. Retrieved from: https://www.oapen.org/download?type=document&docid=1004988#page=299 [Retrieved on: 2.01.2020]

bis.org (2019), Economic growth, credit, and interest rates Retrieved from: https://www.bis.org/publ/cgfs60.pdf [Retrieved on: 2.01.2020]

bis.org (2019), large banks’ fully phased-in Basel II regulatory ratios Retrieved from: https://www.bis.org/publ/cgfs60.pdf [Retrieved on: 2.01.2020]

Black, S., Chapman, B., & Windsor, C. (2017). Australian Capital Flows. RBA Bulletin, June, 23-34. Retrieved from: https://ho.website.rba.gov.au/publications/bulletin/2017/jun/pdf/bu-0617-reserve-bank-bulletin.pdf#page=26 [Retrieved on: 2.01.2020]

Cheung, B. (2017). Developments in Banks’ Funding Costs and Lending Rates. The Recent Economic Performance of the States 1 Insights into Low Wage Growth in Australia 13 Housing Market Turnover 21 Inflation Expectations in Advanced Economies 31 Developments in Banks’ Funding Costs and Lending Rates 45, 45. Retrieved from: https://rba.gov.au/publications/bulletin/2017/mar/pdf/bu-0317-reserve-bank-bulletin.pdf#page=48 [Retrieved on: 2.01.2020]

commbank.com.au (2019), about the company Retrieved from: https://www.commbank.com.au/ [Retrieved on: 2.01.2020]

Conley, T. (2018). The stretched rubber band: banks, houses, debt and vulnerability in Australia. Australian Journal of Political Science, 53(1), 40-56. Retrieved from: http://www.academia.edu/download/56282127/Conley_2017_-_The_stretched_rubber_band_banks_houses_debt_and_vulnerability_in_Australia.pdf [Retrieved on: 2.01.2020]

Craig, B., & Saldías, M. (2016). Spatial dependence and data-driven networks of international banks. International Monetary Fund. Retrieved from: https://www.imf.org/~/media/Websites/IMF/imported-full-text-pdf/external/pubs/ft/wp/2016/_wp16184.ashx [Retrieved on: 2.01.2020]

heritage.com.au (2019) about the company Retrieved from: https://www.heritage.com.au/ [Retrieved on: 2.01.2020]

nab.com.au (2019), about the company Retrieved from: https://www.nab.com.au/ [Retrieved on: 2.01.2020]

westpac.com.au (2019) about the company Retrieved from: https://www.westpac.com.au/ [Retrieved on: 2.01.2020]