UK car industry

The automobile industry is a multi-billion-dollar industry worldwide, however this is highly competitive with numerous big players try to gain a competitive edge by becoming the majority or the part of the whole market share in the United Kingdom.

Moreover, industrial environmental aspects play a vital role. Therefore, car manufacturers cannot rely solely on reliability and safety to stay competitive in the UK car market, particularly due to the maturity of the industry.

This study will summarize the trends in sales of the car organizations within the United Kingdom. This study aims to recognize the market structure of the entire car industry within the United Kingdom.

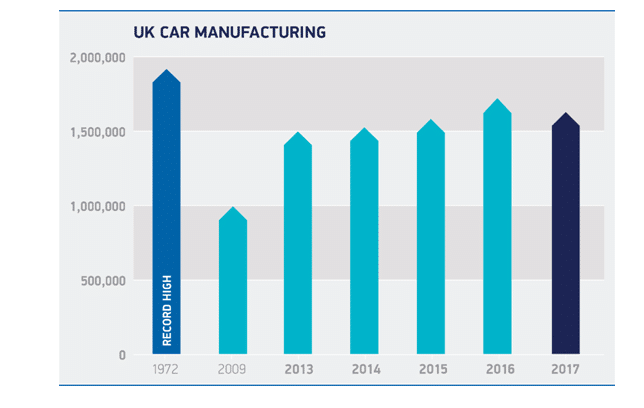

2.a. The automotive manufacturing industry has been producing for the last five years. In the early days, the strong development was driven by the achievement in exporting car to developing economy countries and increasing new car registrations.

Moreover, these factors are driven by the strong consumer confidence, short financial contracts and increasing financial earnings that increase domestic demand. However, according to data from the “Society of Motor Manufacturers and Traders” (SMMT), the production has continued to decrease, including output down4% in 2017 compare to 2018 (Aminand Smith, 2017).

The UK car market is now well known for premium car and sports brands, such as Bentley, Aston Martin,Caterham Cars, Jaguar, Daimler,Lagonda, Lister Cars, Lotus, Land Rover, McLaren, Mini, MG, Roll-Royce and Morgan. The UK has a great presence of volume car manufacturers, such as Nissan, Honda, Voxhall Motors, and Toyota.

Along with that, the commercial car manufacturers dynamic in the UK, such as Ford, Alexander Dennis, IBC Vehicles, London EV Company, and Leyland Trucks.

In 2018, the UK automotive manufacturing sector is valued at £82 billion, making the UK economy £18.6 billion and producing around 1.5 million passenger cars as well as 85,000 commercial cars.

There are about 168,000 people who work directly in the UK car manufacturing supplies, including another 824,000 people worked in the automobile retail, servicing, and supply. It declined to 148,000 with supply industry in 2014 (-18%).

Further, the United Kingdom is foremost center of engine production and in 2018 the country produced about 2.71 million machines. Moreover, this countryhas a noteworthy existence in auto racing as well as the motorsport industry of UK now around 39,000 people, including almost 4,500 organizations and havethe annual turnoverabout$6 billion (Begleyet al. 2015).

The beginnings of the British automotive industry began in the late 19th century. In 1950, the United Kingdom was the world’s largest exporter and the second largest manufacturer among the world (after the US).

In recent decades, however, the industry has grown slower than competing countries such as Japan, Germany, and France, as well asthe United Kingdom was the 12thlargest car manufacturer determined by the volume in 2008.

Several British car brands have been acquired by the foreign organization since 1990s, including “BMW (Mini and Rolls-Royce), SAIC (MG), Tata (Jaguar and Land Rover), as well as Volkswagen Group (Bentley)”. The right of many latent signs is now also owned by foreign companies, such as Riley,Austin, Triumph, and Rover, are similarly owned by the overseas firms (Colino, 2010).

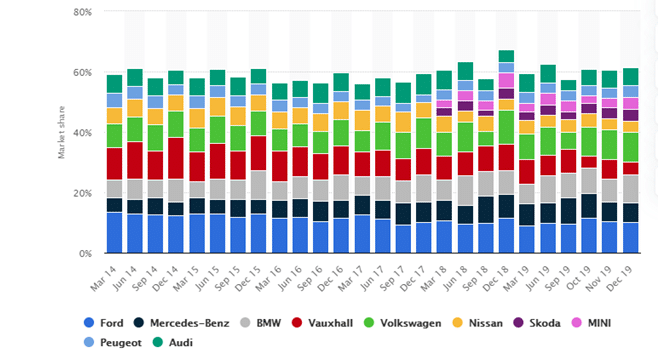

Fig: Comparison of leading car companies’ market share in the UK

Source: https://www.statista.com/statistics/300467/leading-car-companies-market-share-in-the-united-kingdom/

b)The UK car market is extensively competitive in terms of the return on investment. This is considered as an oligopoly market. Previously, the competition was not just about the price of a car, just to gain more market share through innovative technology and design. The UK car market has been classified as a growing broad mass market.

The small car market discovers itself at the top of this emerging market (Patrucco, 2014). They can be classified into two separate vehicles because of different car models. In this way,most models are positioned in the city or mini or supermini part as well as some people who live in small/lower medium family.

While the cost of driving is largely due to taxes, the cost of traffic congestion and other factors, the market share for both categories dominates the industry, while the sales in the supermini section show strong growth of industry leaders.

Along with that, the higher sales trend of the Supermini model is clearly proven, the 44% development in this segment is encouraged by the continual addition of new and improved features introduced by the manufacturers. Britain became the second largest car market for new registrationin the European Union after Germany in 2003.

The new car was assessed at valued£33.5 billionrather than a comparatively small increase of 3.4% on the year as well as 14% progress over five years (Trkman, 2010).

Fig: UK car production

Source: https://www.smmt.co.uk/industry-topics/economy/

- c) There are perfect barriers to entry into this industry, which has become a real threat to new entrants. Some new entrepreneurs or players may enter the automotive industry as they require high capital investment to establish production facilities and distribution networks.

Additionally, the fact that the current multi-national competitors are advancing from an economy of scale and opportunity makes it very problematic to offer a competitive price to a new entrant. Eventually, as the issues of durability, safety, and reliability are so prominent. As the customer base theirimpression of the model on the previous performance of the manufacturers on the issue, it became increasingly difficult to compete with new entrants.

It took a lot of years for the new entrant to make a strong reputation for competition. Everyaspect can reduce the threat of new entrantin the car market very low.Therefore, entry to the car market needs significant capital,managerial and technicalskills, and the time required to achieve a market acceptance which willmake sales and adequate revenue for operation without the requirement of cash infusion from finance activities and investors (Daunorienėet al. 2015).

- d) Competitiveness is defined as the ability of a business to compete successfully as well as profitability in non-price and price term compete in terms of price and quality across global markets. The main method of cost competition is the cost competitiveness is relative unit labor costs while offer indicator can be used. Most car manufacturers operate within the oligopoly market structure so competition is not about price as well as significant product design, brand functionality and environmental impact.

Point 1

The level of labor productivity and labor costs in the UK automotive industry affect the economy for competition. If British-based companies like Toyota in Derbyshire, Honda in Swindon, and Nissan in Tyne & Wear can increase labor productivity per person worked or per hour worked. For a given wages level, the unit cost of the car will allow more sales in the market.

The productivity could be improved by increasing the human capital of the workforce by skill training; through join in lean manufacturing method into the production and by the improved administration. The development in productivity, ceteris paribus will lessen the average and marginal cost of manufacturing each car and empower carmaker to reduce their price whereas making adequate super nominal profit (Ivascuet al. 2016).

Point 2

One of the macroeconomic effects of spending competition is the external value of sterling in contrast to the major trading partners of UK. Moreover, the extract states that 80% of cars produced in the UK are exported, thus the prices of sterling against US dollars, euros and currencies such as the Turkish lira and Yuan will have an outcome. Since the Brexit vote in June 2016, the sterling has fallen by almost 20% on the trade-weighted basis.

It has supported to make UK car exports more price competitive as the foreign values of UK vehicleswill decrease. These comparative price changes have resulted in price changes with foreign consumers who are more likely to purchase British cars so they can get better prices. Increased export sales will boost UK car output, employment, and profits (Lääts, 2011).

Point 3

The second macroeconomic impact of price competitiveness in the UK car market, which is continuedtariff-free access to large export markets of the UK. Britain will leave the EU Custom union after the Brexit transition period in December 2020.

Moreover, the custom union is a trade agreement among nation in which they have tariff-free trade among thembut decide a common external tariff for service and products coming into the European Union. The UK car manufacturer recently export without the tariff into the United Kingdom.

Thus, their competitiveness is not affected by the artificial trade barrier. However, if the UK fails to negotiate a comprehensive trade agreement with the EU in the next month, the car manufacturers here are likely to raise EU tariffs on every non-EU car by 11%.

Also,a tariff increases to the value of exports and – Cetarisperibis – makes the competition worse (Ward and Begg, 2016). This could lead to decay in the UK vehicle sales to the EU as well asthe risk of lost job from declining demand and several capital flights as companies like Honda and Ford that prefer to go to lower-cost nations like the Czech Republic, Poland, and Slovakia.

The impact of import tariff on UK car manufacturers is shown in the analysis diagram. Moreover, a tariff raises the price of UK exports and leads to a contraction in demand and production. It will have a knock-on effect on the supply chain industry (Slomanand Jones, 2019).

Despite the growth potential of this industry, it is optimistic to fight the long-running management conditions for five long years. Moreover, the car manufacturers are predictable to achieve estimate improvementin major export markets such as Continental Europe and the United States.

However, it is not yet clear whether trade tariff or other barriers to trade will be presented. The “Society of Motor Manufacturers and Traders” (SMMT) and other industry stakeholders have refused to a no-deal exit from the EU, demand from Continental Europe might be quiet. However, operators expect export earnings to expand in the long-term because emerging market demand keeps increasesin proportion to the improvement of global economic circumstances.

Amin, A. and Smith, I., 2017. Vertical integration or disintegration? The case of the UK car parts industry. In Restructuring the global automobile industry (pp. 169-199). Routledge.

Begley, J., Collis, C. and Donnelly, T., 2015. Skills shortages: A brake on the British car industry?. Local Economy, 30(6), pp.593-608.

Colino, S.M., 2010. Recent changes in the regulation of motor vehicle distribution in Europe–Questioning the logic of sector-specific rules for the car industry. Competition Law Review, 6(2), pp.203-224.

Daunorienė, A., Drakšaitė, A., Snieška, V. and Valodkienė, G., 2015. Evaluating sustainability of sharing economy business models. Procedia-Social and Behavioral Sciences, 213, pp.836-841.

Ivascu, L., Cirjaliu, B. and Draghici, A., 2016. Business model for the university-industry collaboration in open innovation. Procedia Economics and Finance, 39(November 2015), pp.674-678.

Lääts, K., 2011. Management accounting change in a dynamic economic environment based on examples from business and public sector organizations (Doctoral dissertation).

Patrucco, P.P., 2014. The evolution of knowledge organization and the emergence of a platform for innovation in the car industry. Industry and Innovation, 21(3), pp.243-266.

Sloman, J. and Jones, E., 2019. Essential economics for business. Pearson Higher Ed.

Trkman, P., 2010. The critical success factors of business process management. International journal of information management, 30(2), pp.125-134.

Ward, D. and Begg, D., 2016. Economics for business. McGraw-Hill.

That is a really good tip particularly to those fresh to the blogosphere. Brief but very precise infoÖ Appreciate your sharing this one. A must read article!

https://suba.me/

Very neat article. Much obliged.

https://augustaseoweb.com/roofing-contractor-augusta

play slots online free slots games online slots

https://lifecyclestage.blogspot.com/2023/04/the-college-experience-guide-for.html

I really like and appreciate your article.Much thanks again. Fantastic.

https://augustaseoweb.com/bankruptcy-attorney-augusta

Thanks-a-mundo for the blog.Really thank you! Want more.

https://augustaseoweb.com/therapist-columbia

Perfectly composed articles, thank you for information. “Life is God’s novel. Let him write it.” by Isaac Bashevis Singer.

https://wreckingballinsights.com/

Generally I do not read article on blogs, however I would like to say that this write-up very pressured me totry and do so! Your writing taste has been surprised me.Thanks, quite great post.

https://4.ly/atrKR

I truly value your piece of work, Great post.

http://betacooks.com/members/pantrywriter7/activity/33432/

I need to to thank you for this good read!! I certainly loved every bit of it. I have got you saved as a favorite to check out new things you post…

https://andypausoccer.wordpress.com/

WE HELP YOU SOLVE THE PROBLEMS IN YOUR LIFE AND IN YOUR RELATIONSHIPS(Offices all over the UK)

https://relationshipsmdd.com/how-to-feel-more-attractive-and-confident-in-college/

Very neat blog post.Really looking forward to read more. Great.

https://www.kingkardpf.com/nl/product/dpf-reinigingsmachine-5-0

I am so grateful for your post.

https://www.torvenics.com/fpc_connectors

I truly appreciate this blog article.Much thanks again. Awesome.

https://www.mingdeplastic.com

union landing apartments kingsville apartments berkeley place apartments

http://mrmilehy.club/mrmilehyclubgmail-com-or-512-910-7744-text-only-ugly-building-modifier-janitor-austin-texas-addie-allie-jack-golf-flyfishing/greekskin73/activity/39956/

Pretty! This has been an incredibly wonderful post. Thank you for supplying this info.

https://www.siatex.com/promotional-t-shirt-suppliers-manufacturers-in-bangladesh/

great for me – good and best article , perfect

http://onlywe.site/story.php?id=23159

Hello, its good post on the topic of media print, we allunderstand media is a impressive source of information.

https://coincoach.ca/members/moleturn1/activity/280467/

I love the beneficial details presented in your posts.

https://cutt.ly/v6dFij3

No matter if some one searches for his necessarything, so he/she wishes to be available that in detail,therefore that thing is maintained over here.

I truly appreciate this blog.Really looking forward to read more. Awesome.

http://www.bizholi.com/m/shop/index.php?no=139

antibiotic definition flagyl antibiotic – bactrim medicine

https://www.mentorhub.info/business-growth/carbonclick

Toes, soles, foot joi, shoejob, toejob, fetish, sockjob, nylon, stockings, solejob

https://coolpot.stream/story.php?title=ontario-online-casinos-6#discuss

I cannot thank you enough for the blog post.Much thanks again. Keep writing.

https://store.smoktech.com/product/details/novo-bar-b600

What’s up i am kavin, its my first occasion to commenting anyplace, when i read this piece of writing i thought icould also create comment due to this sensible paragraph.

https://halberg-daly-2.thoughtlanes.net/soccer-sports-betting-guidelines-to-remember-while-betting-online

I really enjoy the blog post.Really thank you! Want more.

https://ttrebags.com/

bisoprolol classification ramipril classification furosemide medication

https://freebookmarkstore.win/story.php?title=roulette-game-5#discuss

Thanks ffor the good writeup. It actually used to be a leisure account it.Glanc complex to more added agreeable from you!However, how could we keep up a correspondence?

https://cutt.ly/V5U5cJo

ivermectin for chickens dosage does ivermectin kill fleas

https://justbookmark.win/story.php?title=mercedes-lang-ha#discuss

Hi friends, good piece of writing and nice urging commented at this place, I am in fact enjoying by these.

I think this is a real great blog article. Want more.

https://www.chinatopmarketing.com/baidu-seo-service.html

canadian healthcare pharmacy review Aristocort

http://sortrugby43.jigsy.com/entries/general/-Online-football-betting-done-appropriate0A

Thanks-a-mundo for the article. Cool.

https://questromcommon.bu.edu/click?uid=cb9cdd04-d381-11e7-97c4-0a25fd5e4565&r=https://www.monmall.ph/instax-film-price-philippines

Very informative article post.Thanks Again. Really Cool.

https://www.gkindex.com/java-priorityblockingqueue

Great, thanks for sharing this blog post.Thanks Again. Cool.

https://santos-riggs.hubstack.net/seven-many-different-utilizes-of-aluminum-profiles

ivermectin pyrantel pamoate human ivermectin

https://higgins-knudsen.federatedjournals.com/information-you-need-to-learn-about-what-is-a-data-warehouse

fantastic issues altogether, you simply received abrand new reader. What would you recommend in regards to your post that you made a few days ago?Any sure?

https://www.reddit.com/r/CAPITAL_NEWSWIRE/comments/twwrlp/the_power_play_by_the_market_herald_canada/

Great, thanks for sharing this blog article.Thanks Again. Really Cool.

https://www.reddit.com/r/reddit_NEWSWIRE/comments/tvtpeb/the_power_play_by_the_market_herald/

Wow, great post. Keep writing.

https://www.bestwaybags.com

Amazing a lot of superb tips!essay writing tools dissertation online i need someone to write my assignment

Good day! This is my first visit to your blog! We are a group of volunteers and starting anew project in a community in the same niche. Your blog provided usvaluable information to work on. You have done a outstanding job!

https://pastelink.net/qzn87wpq

Appropriate Standard Thirty seven carries a free-sprung stability with out regulator, including Patek Philippe’s Gyromax, and the rate is adjusted by simply Four weight screws (within platinum) on the harmony edge.

https://support.mozilla.org/en-US/user/brian55441/

Thank you for your blog article.Much thanks again. Fantastic.

https://www.elt-holdings.com/ru/product_show/cs5qqa5t19ckg/§і§д§С§Я§Х§С§в§д§Я§н§Ц-§Э§Ъ§д§н§Ц-§Х§Ц§д§С§Э§Ъ

what is losartan] what is losartan] what is losartan]

https://7.ly/avRZ6

A big thank you for your article post. Will read on…

https://www.elt-holdings.com/en/product_show/2d45r20i3iasc/Tube-Plastic-Parts

I think this is a real great blog.Much thanks again.

https://www.cokohardware.com/forging

Hi! I know this is kind of off topic but I waswondering if you knew where I could find a captcha plugin for my comment form?I’m using the same blog platform as yours and I’m having problems finding one?Thanks a lot!

A fascinating discussion is definitely worth comment. I think that you need to write more on this subject, it may not be a taboo subject but usually people do not discuss these issues. To the next! Cheers!

https://devpost.com/vangsullivan985

I like this blog so much, saved to my bookmarks .poker idn terpercaya

https://geograffity.com/post/718134917176950784/discover-the-impact-of-alcohol-on-your-freediving

A big thank you for your article post.Really looking forward to read more. Much obliged.

https://telegra.ph/Specifics-It-Is-Important-To-Find-Out-About-What-Is-Auxiliary-System-In-Vehicle-06-05

magnificent issues altogether, you simply received a new reader.What could you suggest about your publish that you just made a few days in thepast? Any sure?

Has anyone ever vaped Phillip Rocke Grand Reserve Vape Juice?

https://www.complaintsboard.com/noel-meza-attorney-san-diego-unethical-attorney-services-c1583489

I want to to thank you for this good read!!I definitely enjoyed every little bit of it.I have you book marked to look at new things you post…

https://www.fool.com/investing/2023/02/17/why-arqit-quantum-stock-collapsed-today/

A motivating discussion is worth comment. I believe that you should write more about this topic, it might not be a taboo matter but generally folks don’t speak about such subjects. To the next! Cheers!

https://edu.fudanedu.uk/user/orval88054/

Howdy! This post couldnít be written much better! Looking at this post reminds me of my previous roommate! He constantly kept talking about this. I will forward this post to him. Pretty sure he will have a good read. Thanks for sharing!

https://damoaberry.com

Tepziq – finding sources for research papers Tocxow ewuqcd

https://www.logirobotix.com/

Aloha! Such a nice post! I’m really appreciate it.

Heya i am for the primary time here. I came across this board and I find It truly useful & it helped me out a lot. I am hoping to give something again and aid others such as you aided me.

Thanks for sharing, this is a fantastic post.Much thanks again. Keep writing.

https://www.sbssibo.com

Amazing data. Regards!essays college top 5 essay writing services professional ghostwriter

https://weeklycasinos.com

A round of applause for your blog.Really looking forward to read more. Fantastic.

https://etransaxle.com/

Different subject… if you’re looking to trade stocks or Forex, take a look as this free PDF. It helped me and I’m confident it can help you too:

http://gameexeter.art/story.php?id=26670

Amazing. Guru. You’re a new master. Give thanks to you.

https://eubd.edu.ba/

Excellent blog you have here.. It’s difficult to find excellent writing like yours nowadays.I really appreciate people like you! Take care!!

https://onearchersplace.net/

Hello there! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Thank you!

http://scottcritiques.com/20-little-bit-of-recognized-truths-concerning-pokemon-card-shop-melbourne/

Good blog you have got here.. It’s difficult to find excellent writinglike yours nowadays. I truly appreciate people likeyou! Take care!!

Excellent post however , I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further. Many thanks!

https://designcanyon.com/wordpress/from-campgrounds-to-pet-hotels-wordpress-templates-for-every-industry/

Ahaa, its fastidious dialogue on the topic of this article here at this blog, I haveread all that, so at this time me also commenting at this place.

https://sincere-peach-wrl9hz.mystrikingly.com/blog/add-a-blog-post-title

What a information of un-ambiguity and preserveness of valuableknowledge concerning unexpected feelings.

https://tahaus.org/members/libratrunk90/activity/36575/

Aw, this was an incredibly good post. Taking the time and actual effort to create a superb article… but what can I say… I put things off a lot and never manage to get nearly anything done.

http://freecoursesites.art/story.php?id=30888

Enjoyed every bit of your article post.Really thank you! Awesome.

https://rush-one.net/products/E5A5B3E69E9CE5878DOralJellyP-ForceE99B99E69588E5A881E8808CE98BBC160mg7E585A5E8A39DE78EABE791B0E58FA3E591B3-648be78566011a46.html

Thanks a lot for the blog.Much thanks again. Much obliged.

https://www.addgoodsites.com/Business/Business_Services/

Really enjoyed this blog post.Thanks Again. Great.

https://myonlinestudybuddy.com/members/bullfather5/activity/231972/

Good blog! I truly love how it is simple on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I have subscribed to your RSS which must do the trick! Have a nice day!

https://gorod-lugansk.com/user/heightprice9/

Why do copyright holders only allow people from certain countries to view their content?

https://www.wppremiumfree.com/author/273januaryfairies/

A round of applause for your article post.Really looking forward to read more. Keep writing.

https://loboose-side-effects08471.activosblog.com/22218452/the-greatest-guide-to-naturstein-hage

Thank you for the good writeup. It in reality wasonce a entertainment account it. Glance advanced to far introduced agreeable from you!By the way, how could we keep up a correspondence?

F*ckin’ amazing things here. I’m very glad to see your article. Thanks a lot and i am looking forward to contact you. Will you please drop me a mail?

https://coincoach.ca/members/bootmath8/activity/702901/

Thanks-a-mundo for the blog post. Keep writing.

https://www.marklifeprinter.com/

I really like and appreciate your blog post.Much thanks again. Keep writing.

https://www.uniquehairextension.com/product/clip-in-extensions.html

I truly appreciate this article. Great.

https://www.medlonchina.com/Tbar-T-bar-connector-52630.html

Having read this I thought it was extremely informative. I appreciate you taking the time and energy to put this article together. I once again find myself spending a lot of time both reading and posting comments. But so what, it was still worth it!

https://maps.google.ml/url?q=https://www.jumpcentralofaugusta.com/

Thanks for sharing, this is a fantastic blog article.Much thanks again. Fantastic.

https://www.beautychemical.com/Products/Trichloroisocyanuric-acid_06.html

wow, awesome post.Much thanks again. Will read on…

https://www.beautychemical.com/Products/4-4-Oxydianiline_08.html

I blog often and I seriously appreciate your information. The article has really peaked myinterest. I’m going to bookmark your blog and keep checking for new information about once a week.I opted in for your RSS feed as well.

I needed to thank you for this very good read!! I definitely enjoyed every bit of it. I have got you bookmarked to look at new stuff you postÖ

Hi! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche.Your blog provided us valuable information to work on. You have done a outstanding job!

I appreciate you sharing this blog article.Thanks Again. Cool.

https://www.sbssibo.com/products/

There is definately a lot to find out about this topic. I like all of the points you’ve made.

http://mysterycafe.site/story.php?id=30969

Atentie sa nu va luati si voi teapa cum am luat eu de la firma Creativ TRD SRL pe lucrare-licenta.eu care vind lucrari plagiate.

https://www.openlearning.com/u/kleinzachariassen-rxf112/blog/FactsYouShouldBeInformedAboutEightGreatThingsAboutTownhouseResiding

Great blog post.Thanks Again. Cool.

https://spriteshield.com/products/temporary-floor-protection-for-construction-renovation

Thanks-a-mundo for the article post.Really thank you! Much obliged.

https://n.pisopanalo.ph/

ivermectin for humans for sale ivermectin for humans over the counter

http://mrmilehy.club/mrmilehyclubgmail-com-or-512-910-7744-text-only-ugly-building-modifier-janitor-austin-texas-addie-allie-jack-golf-flyfishing/rakecar51/activity/442783/

can you take azithromycin with flexeril – z pack over the counter z pack contents

Right now it sounds like Drupal is the preferred blogging platform out there right now.(from what I’ve read) Is that what you’re using on your blog?Stop by my blog – Forti Prime Review

https://infogalactic.com/info/John_Harvey_Kellogg

Excellent blog you have got here.. It’s hard to find excellent writing like yours nowadays. I seriously appreciate people like you! Take care!!

http://www.klanau.kr.ua/index.php/ua/home-ua/news/913-2016-03-21-07-19-05

I truly appreciate this blog post. Will read on…

https://learncswithus.com/2023/01/16/e4bba3e58699e6a188e4be8b-data-structure/

I don’t even know how I ended up here, but I thought this post was great.I don’t know who you are but definitely you are going to afamous blogger if you are not already 😉 Cheers!

https://pagan.com.ua/privitannya/garni-privitannia-z-12-richchiam-z-dnem-narodjennia-12-rokiv-hlopchiky-divchinci-prostimi-slovami/

This is a topic that’s close to my heart… Thank you! Where areyour contact details though?

kind of pattern is usually seen in Outlet Gucci series. A good example is the best.

Great blog.Thanks Again. Will read on…

https://yiyuanzhengming.com/

What’s up, its fastidious piece of writing about media print, we all understand media is a fantastic sourceof information.

http://iot.ttu.edu.tw/members/cammilegoddu/

I am so grateful for your article.Really thank you! Really Cool.

https://www.arixlash.com/PRODUCTS/Cluster-Individual-Lashes_020.html

Thank you for the auspicious writeup. It actually used to be a leisure account it.Look complex to far introduced agreeable from you!By the way, how could we communicate?My blog post 23.95.102.216

https://qr.ae/pyWJy8

Looking forward to reading more. Great post.Really looking forward to read more. Great.

https://yiyuanzhengming.com/

Hello, just wanted to say, I enjoyed this blog post. It was practical. Keep on posting!

With 19 tables waiting for you, odds are you are in for the timeof your life.

Say, you got a nice article.Really thank you!Loading…

This activity will allow you to to enhance your overall state of body fitness.

Fantastic article.Really looking forward to read more. Great.

https://ala3raf.net/user/drainedge27

chloroquine primaquine hydroxychloroquine update today

http://stjosephsgeorgerow.org/

ed causes and treatment generic ed pills – ed treatments

https://ventsmagazine.com/2023/06/14/the-success-of-youth-empowerment-programs/

Deference to op, some fantastic entropy.my blog post; bogema.anapacenter.info

https://te.legra.ph/Check-out-Caesardoor-today-and-find-something-right-07-21

Pretty nice post. I just stumbled upon your blog and wished to say that I have truly enjoyed browsing your blog posts. In any case I’ll be subscribing to your rss feed and I hope you write again soon!

I am not rattling wonderful with English but I get hold this really leisurely to interpret .

http://www.turkiyemsin.net/author/notifybrandy91/

What’s up, after reading this remarkable post i amas well glad to share my familiarity here with colleagues.

http://universalsteps.online/story.php?id=30008

I am an adult female who is 37 years old thanx.

https://stoutcarver47.livejournal.com/profile

I really like and appreciate your article.Really thank you!

https://www.hengyitek.com/product/pigment-violet-27/

Muchos Gracias for your article post.Much thanks again.

https://saveyoursite.win/story.php?title=1-ace-betting-app#discuss

Looking forward to reading more. Great blog article.Much thanks again. Really Cool.

https://www.hengyitek.com/rutile-titanium-dioxide/

Thank you for your blog.Much thanks again. Really Great.

https://www.shoemee.com/product/canvas-slip-on-cloth-shoes-for-women/

I really like reading through an article that can make men and women think. Also, thank you for allowing for me to comment!

https://coincoach.ca/members/bankrise5/activity/969140/

Muchos Gracias for your post.Really thank you!

https://bespoketails.com/product-category/dress/

Very good article post.Much thanks again. Want more.

https://raymondouxbe.blogstival.com/42728777/considerations-to-know-about-tattoo-aftercare-cream

Howdy! This is my first visit to your blog! We are a group of volunteers and starting a new project in a community in the same niche. Your blog provided us beneficial information to work on. You have done a extraordinary job!

https://matmartial.com/members/tirecarp03/activity/21661/

Great, thanks for sharing this blog article.Really looking forward to read more. Awesome.

https://rafaeluzehj.aioblogs.com/74074577/klinikk-i-lillestrøm-for-dummies

Thanks for the post.Really thank you! Much obliged.

https://cristianvzdgj.jiliblog.com/78508153/buy-windows-10-an-overview

Now I am going away to do my breakfast, once having mybreakfast coming over again to read additional news.

https://reupper.com/members/recesshour05/activity/89181/

Im thankful for the blog post. Cool.

https://rotontek.com

Thanks again for the post.Much thanks again. Great.

https://bingoregister.com

Great info. Lucky me I recently found your blog by chance (stumbleupon).I’ve bookmarked it for later!

https://ur3.us/azFac

Great write-up, I am regular visitor of one?¦s blog, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.

http://cropporch77.jigsy.com/entries/general/Nurturing-And-Guiding-Artificial-Intelligence-From-Infancy-To-Adolescence0A

I loved your blog post.Much thanks again. Much obliged.

https://www.panda-admission.com

Really appreciate you sharing this blog post.Thanks Again. Keep writing.

https://www.hongyongmachinery.com/p-CNC-Maching-Parts-293687/

Really appreciate you sharing this blog.Really thank you! Cool.

https://beauntxbd.is-blog.com/26781688/a-review-of-world-777

Really informative blog. Keep writing.

https://vpnregister.com/

Enjoyed every bit of your blog post. Will read on…

https://www.speed-doors.com

A big thank you for your article post.Really looking forward to read more. Much obliged.

https://en.tongwei.com.cn

Really informative blog article.Really thank you! Awesome.

https://www.csppm-sensor.com/products.html

Thanks a lot for the blog post.Really thank you! Cool.

https://www.anclighting.com/table-lamps/

It’s hard to come by experienced people on this subject, however, you sound like you know what you’re talking about! Thanks

https://progress.guide/members/foambeetle61/activity/146636/

Thank you for your article post.Really looking forward to read more. Will read on…

https://chennai-to-pondicherry-ro14441.newsbloger.com/24206591/fascination-about-holiday-tour-packages

wow, awesome post.Much thanks again. Great.

https://wholesale-nutrition72716.full-design.com/the-smart-trick-of-sleeping-bag-for-rental-in-bangalore-that-nobody-is-discussing-63259164

Appreciate you sharing, great article post.Much thanks again. Great.

https://www.shjlpack.com/info/pipe-bundling-machine-and-pipe-bundle-packing/

I appreciate you sharing this article.Really looking forward to read more. Cool.

http://blog.twinspires.com/2012/06/cotolos-harness-review-news-and-notes.html?sc=1690032600751#c3116159179612130451

One of the most popular live chat sites online. A selection of chat rooms including chat, singles chat, cam chat

I loved your article. Really Cool.

https://kuafotiyu.com

I really like and appreciate your blog post.Thanks Again. Cool.

https://www.irontechdoll.com

I really like and appreciate your article.Much thanks again. Much obliged.

https://chanceptwwt.post-blogs.com/41768520/online-web-development-bootcamp-things-to-know-before-you-buy

Really informative article post.Much thanks again. Fantastic.

https://brooksckpux.ja-blog.com/22085458/yoga-in-goa-secrets

Very informative post.Really thank you! Awesome.

https://johnathanpswzd.pages10.com/satta-matka-can-be-fun-for-anyone-57425251

Im grateful for the blog post.Thanks Again. Want more.

https://collagen49382.topbloghub.com/27688249/the-single-best-strategy-to-use-for-honey

Awesome blog article. Really Great.

http://yousticker.com/#/index/page/0?lang=en&privacy=1&view=fullView&range=1

Thanks a lot for the blog post.Really thank you! Keep writing.

https://www.chemistry-labfurniture.com

Thanks for the blog post.Really looking forward to read more. Will read on…

https://bonito-packaging.com/

I think this is a real great blog.Really looking forward to read more. Great.

https://wheyprotein27271.blogsmine.com/1566762/indicators-on-char-dham-yatra-package-for-senior-citizens-you-should-know

Fantastic blog article.Much thanks again. Fantastic.

https://www.torvenics.com/products/

Appreciate you sharing, great blog post.Really thank you! Really Great.

https://www.mengcaii.com/

I loved your blog post.Thanks Again. Much obliged.

https://archerxaant.blogaritma.com/22904983/how-website-link-can-save-you-time-stress-and-money

Really informative article.Much thanks again. Awesome.

https://www.tinpackagingbox.com/product/Octagonal-shape-tin-box-with-mirror-for-sexy-eye-kit-Benefit-Cosmetics.html

Enjoyed every bit of your blog article.Really looking forward to read more. Great.

https://lireplica.x.yupoo.com/categories/2958181

I am so grateful for your blog post.Really looking forward to read more. Awesome.

https://honeylovedoll.com/

Looking forward to reading more. Great blog post. Want more.

https://www.jianghehaisteels.com/

Enjoyed every bit of your blog.Really looking forward to read more. Really Cool.

https://www.honestyoutdoor.com/en/product/products-5-97.html

Fantastic blog.Really looking forward to read more. Really Cool.

http://fdautoparts.com/

Very good post.Really thank you! Much obliged.

https://www.domo-bath.com/products/13×20-staggered-stone-pattern-shower-wall-panels/

Really appreciate you sharing this blog article. Really Great.

https://youxiaohao.com

A round of applause for your article post.Really looking forward to read more. Much obliged.

https://www.orangenews.hk/

Wow, great article post.Much thanks again. Awesome.

https://tototires.com/

Hey, thanks for the article post. Great.

https://acertdglobalplatform.mn.co/posts/44102352

Very good article post.Thanks Again. Want more.

https://network-5018780.mn.co/posts/43738977

I really enjoy the blog.Really thank you! Really Great.

https://daltonhz6yl.worldblogged.com/28910743/dpboss-satta-matka-things-to-know-before-you-buy

Hey there! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post or vice-versa? My site discusses a lot of the same topics as yours and I feel we could greatly benefit from each other. If you might be interested feel free to shoot me an e-mail. I look forward to hearing from you! Awesome blog by the way!

http://sports.unisda.ac.id/

Would you be fascinated by exchanging links?

http://www.familyvictory.com/

Wow, great blog. Cool.

https://gainweb.org/Business_and_Economy/Business_Services/

Thanks for the article post. Really Great.

http://www.helpdesk.ipt.pw/News/business-supply/

Thanks for the suggestions you have discussed here. In addition, I believe there are some factors that will keep your car insurance premium straight down. One is, to take into consideration buying vehicles that are from the good report on car insurance organizations. Cars that happen to be expensive tend to be at risk of being lost. Aside from that insurance policies are also in accordance with the value of your truck, so the higher in price it is, then the higher the particular premium you spend.

https://lodgeservice.com/

http://www.bestartdeals.com.au is Australia’s Trusted Online Canvas Prints Art Gallery. We offer 100 percent high quality budget wall art prints online since 2009. Get 30-70 percent OFF store wide sale, Prints starts $20, FREE Delivery Australia, NZ, USA. We do Worldwide Shipping across 50+ Countries.

https://bestartdeals.com.au/modern-art-prints/

I’ve learned some important things via your post. I would also like to express that there might be situation in which you will obtain a loan and never need a cosigner such as a U.S. Student Aid Loan. However, if you are getting credit through a common loan provider then you need to be ready to have a cosigner ready to help you. The lenders are going to base that decision over a few components but the greatest will be your credit worthiness. There are some lenders that will also look at your job history and choose based on this but in most cases it will depend on your score.

https://www.hanfosan.de/hhc.html

Thanks so much for the post.Really thank you! Great.

https://www.sarms4muscle.com/products/retatrutide-cas-2381089-83-2

you are really a good webmaster. The website loading speed is incredible. It seems that you are doing any unique trick. Also, The contents are masterpiece. you’ve done a excellent job on this topic!

https://lodgeservice.com/

I cannot thank you enough for the article.Really looking forward to read more.

https://hindi-news-today90316.free-blogz.com/70867640/considerations-to-know-about-taaza-khabar

Say, you got a nice blog post.Thanks Again. Keep writing.

https://wuxiabkweldmc.com/

Thank you for sharing excellent informations. Your site is so cool. I’m impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found just the info I already searched everywhere and simply could not come across. What a great web-site.

https://tongbigmoney.com/

Great, thanks for sharing this blog.Thanks Again. Fantastic.

https://waylonrnfzq.bloggazzo.com/23714122/detailed-notes-on-cheapest-countries-to-visit-from-india

Really appreciate you sharing this article.Much thanks again. Will read on…

https://thiswebsite55307.post-blogs.com/45063379/indicators-on-kamshet-paragliding-rates-you-should-know

Thank you ever so for you blog post.Really looking forward to read more. Keep writing.

https://www.linkedin.com/in/future-choice-hospitality-4210772a5/

Thanks again for the blog.Thanks Again. Fantastic.

https://www.mixnsip.com/

Good blog post. The things i would like to contribute is that computer system memory must be purchased when your computer still can’t cope with whatever you do along with it. One can install two good old ram boards containing 1GB each, as an example, but not one of 1GB and one with 2GB. One should make sure the manufacturer’s documentation for own PC to make sure what type of memory space is necessary.

https://xdj186.com/the-allure-of-progressive-jackpots-chasing-the-big-win/

After I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a remark is added I get 4 emails with the same comment. Is there any method you may remove me from that service? Thanks!

https://gotartwork.com/Blog/tap-into-success-choosing-the-best-credit-card-machine-for-your-business/241643/

I?m not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for wonderful information I was looking for this info for my mission.

https://unzippedtv.com/how-much-does-it-cost-to-start-a-payment-gateway/

Music began playing anytime I opened this webpage, so annoying!

https://pain-management.hellobox.co/6588676/payment-revolution-the-merchant-services-evolution

After examine a number of of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark web site record and will be checking again soon. Pls try my web site as nicely and let me know what you think.

https://gamingnetwork.mn.co/posts/47299934

Very neat article post.Thanks Again. Great.

https://www.wozuibao.com/

Very good article.Really thank you! Cool.

https://zhgjaqreport.com/

Since values are personal, it’s common for people to have different opinions. It’s important to engage in discussions respectfully, acknowledging that diverse perspectives exist.

you’re really a good webmaster. The site loading speed is amazing. It seems that you’re doing any unique trick. Also, The contents are masterwork. you have done a excellent job on this topic!

https://mohameddiablawyer.ahladalil.com/t1609-topic#1662

Enjoyed every bit of your post.Thanks Again. Want more.

https://undress-ai.app/

I value the blog article.Really looking forward to read more. Want more.

https://augustyikgd.bloggactivo.com/23859732/helping-the-others-realize-the-advantages-of-government-jobs

Heya! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no data backup. Do you have any methods to prevent hackers?

https://mawartoto-link.mtsn2sumedang.sch.id/

Thanks for the tips about credit repair on your site. The thing I would advice people should be to give up the particular mentality they can buy now and fork out later. Being a society most people tend to try this for many things. This includes family vacations, furniture, in addition to items we’d like. However, it is advisable to separate your own wants out of the needs. While you’re working to improve your credit score you have to make some sacrifices. For example it is possible to shop online to save cash or you can click on second hand stores instead of high-priced department stores regarding clothing.

https://xmlfn.com/empowering-organizations-unveiling-some-great-benefits-of-transaction-processors/

Really enjoyed this article.Much thanks again. Really Cool.

https://www.wireropeassy.com/products

Muchos Gracias for your blog post. Really Cool.

https://www.raettsgroup.com/

I like what you guys are up also. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site 🙂

https://298app4.com/deciding-on-a-service-provider-solutions-company-be-sure-that-recognize/

Major thankies for the article post.Really thank you! Cool.

https://undress.vip/

Please let me know if you’re looking for a writer for your site. You have some really good articles and I feel I would be a good asset. If you ever want to take some of the load off, I’d really like to write some material for your blog in exchange for a link back to mine. Please shoot me an email if interested. Many thanks!

https://lodgeservice.com/what-is-retail-security/

Thanks again for the article.Thanks Again.

https://www.44mold.com/product/plastic-molds/

Aw, this was an incredibly good post. Finding the time and actual effort to generate a superb article… but what can I say… I hesitate a whole lot and never seem to get nearly anything done.

https://filetransfer.io/

Thanks a lot for the post.Really looking forward to read more. Cool.

https://mbti32686.tribunablog.com/delhi-to-agra-one-day-tour-package-an-overview-38564791

I really liked your post.Much thanks again. Really Great.

https://net7758312.blogsidea.com/30197907/getting-my-camping-at-pawna-lake-to-work

Thanks for your posting on this web site. From my very own experience, there are occassions when softening upwards a photograph might provide the photo shooter with a chunk of an creative flare. More often than not however, that soft cloud isn’t what precisely you had in mind and can often times spoil an otherwise good photograph, especially if you anticipate enlarging it.

https://thekingplus.com/

I appreciate you sharing this blog article.Really thank you! Awesome.

https://chai-ai.app/

I have observed that in the world of today, video games are definitely the latest phenomenon with kids of all ages. Occasionally it may be extremely hard to drag your children away from the video games. If you want the best of both worlds, there are many educational activities for kids. Great post.

https://campaignjp.info/top-3-tips-in-choosing-the-best-credit-card-processing-company/

What an eye-opening and meticulously-researched article! The author’s thoroughness and ability to present intricate ideas in a understandable manner is truly commendable. I’m totally captivated by the depth of knowledge showcased in this piece. Thank you, author, for offering your wisdom with us. This article has been a game-changer!

http://brokerforex.website/2023/06/12/what-type-of-services-does-a-web-based-merchant-offer/

Appreciate you sharing, great blog.Really thank you! Want more.

https://cristianvbfos.blogminds.com/not-known-details-about-comprehensive-information-on-diseases-in-india-22500943

Really appreciate you sharing this post.Really thank you! Really Great.

hl6999.com

Fantastic article post.Much thanks again. Keep writing.

https://phd-course73826.ivasdesign.com/46584897/details-fiction-and-phd-course

Thanks for your publication. I also believe laptop computers have gotten more and more popular nowadays, and now will often be the only type of computer included in a household. Simply because at the same time that they’re becoming more and more affordable, their working power keeps growing to the point where there’re as highly effective as personal computers through just a few in years past.

https://snaptik.app/vn

Appreciate you sharing, great blog post.Much thanks again. Really Cool.

https://www.hominers.com/product-category/whatsminer/

Hi, Neat post. There’s a problem with your site in internet explorer, would check this? IE still is the market leader and a huge portion of people will miss your great writing due to this problem.

https://gadgehit.com

I am so grateful for your blog post. Awesome.

https://bestwondercloset.com/collections/replica-adidas-yeezy/

Hi there! This is my first visit to your blog! We are a team of volunteers and starting a new initiative in a community in the same niche. Your blog provided us valuable information to work on. You have done a marvellous job!

https://gadgehit.com

Looking forward to reading more. Great blog post. Really Cool.

https://nsfwgenerator.ai/

Thanks again for the blog.Thanks Again. Fantastic.

https://www.favcomic.com/picture

Really enjoyed this article. Great.

https://mylesqajtc.vidublog.com/24581307/a-secret-weapon-for-best-stays-in-munnar

I loved your post.Really thank you! Cool.

https://chancedimps.jts-blog.com/24482884/the-fact-about-property-rates-in-nagpur-that-no-one-is-suggesting

Thanks for revealing your ideas on this blog. As well, a fantasy regarding the finance institutions intentions when talking about home foreclosure is that the financial institution will not take my repayments. There is a certain amount of time the bank is going to take payments here and there. If you are way too deep inside the hole, they’ll commonly desire that you pay the payment entirely. However, that doesn’t mean that they will not take any sort of repayments at all. Should you and the lender can manage to work one thing out, the actual foreclosure procedure may halt. However, in the event you continue to neglect payments within the new system, the foreclosed process can just pick up from where it was left off.

https://www.to-buy-bearings.com/Aboutus.html

Thanks again for the blog article.Much thanks again. Much obliged.

https://donovanufowi.webbuzzfeed.com/25197481/facts-about-cricket-updates-india-revealed

Im obliged for the article post.

https://home-accessories-near-me12333.slypage.com/25256246/5-simple-techniques-for-home-accessories-near-me

Hey, thanks for the blog.Really looking forward to read more. Great.

https://ricardordpa98653.snack-blog.com/24980349/down-under-dreams-unveiling-the-wonders-of-australia-for-tourists

Really informative post.Thanks Again. Cool.

https://packersandmoverschandigar57899.imblogs.net/74331507/top-latest-five-packers-and-movers-chandigarh-urban-news

I value the blog post.Really looking forward to read more. Really Cool.

https://casinoplus.net.ph/

Great work! That is the kind of info that are supposed to be shared around the web. Disgrace on the search engines for no longer positioning this post upper! Come on over and visit my web site . Thanks =)

http://ftp.apperta.org

Really enjoyed this post.Really thank you! Really Great.

https://dungeonborne.com/act/tuc/index.html

Awesome blog.Really thank you! Want more.

https://slotfortuneclub.com/

I think this is a real great article. Will read on…

https://www.3chlorine.com/

Howdy just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Chrome. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the issue fixed soon. Cheers

https://jasperuwwv40517.develop-blog.com/30769046/level-up-your-leisure-exploring-the-flourishing-entire-world-of-online-game-titles-with-pharaoh-casino

I really liked your blog. Awesome.

https://blog.huddles.app/

Major thankies for the article. Fantastic.

https://crushon.ai/

Very good blog.Thanks Again.

https://www.algaecidetechnologies.com/

Thanks again for the article.Really looking forward to read more.

https://aspireapplianceservices.in/washing-machine-repair-service-centre-saraswathipuram-mysore/

Thank you for your blog.Much thanks again. Much obliged.

https://www.dolphmicrowave.com

Thank you ever so for you blog post. Great.

https://www.rs-fastener.com

In these days of austerity in addition to relative anxiety about getting debt, a lot of people balk up against the idea of making use of a credit card in order to make acquisition of merchandise or maybe pay for a holiday, preferring, instead only to rely on the actual tried and trusted approach to making repayment – raw cash. However, in case you have the cash on hand to make the purchase in whole, then, paradoxically, that is the best time just to be able to use the credit card for several reasons.

https://garrettycca72839.dm-blog.com/25033466/unleashing-the-likely-of-on-the-web-games-for-psychological-nicely-staying

Thank you ever so for you article post.Thanks Again. Want more.

https://www.lianindustrial.com

I cannot thank you enough for the article post.Really looking forward to read more. Really Cool.

https://beaulzmy98754.blogdal.com/25477543/the-advantage-of-business-analyst-course

Muchos Gracias for your blog article.Thanks Again. Great.

https://nsfwcharacters.ai/

Major thanks for the article post. Much thanks again.

My website: порно спит пьяная

Excellent post however I was wondering if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit more. Thank you!

https://suramadu.pta-surabaya.go.id/

Good post. I learn something more difficult on totally different blogs everyday. It would always be stimulating to learn content from different writers and apply a little bit something from their store. I?d want to make use of some with the content material on my weblog whether or not you don?t mind. Natually I?ll provide you with a link on your net blog. Thanks for sharing.

ttps://royalbeautyspanyc.com/

Just want to say your article is as surprising. The clearness in your post is simply cool and i can assume you are an expert on this subject. Well with your permission allow me to grab your feed to keep updated with forthcoming post. Thanks a million and please continue the rewarding work.

https://royalbeautyspanyc.com/

I am incessantly thought about this, thanks for posting.

My website: порно видео русское анал

Thanks for your write-up. What I want to comment on is that when looking for a good on the web electronics store, look for a internet site with entire information on critical indicators such as the level of privacy statement, security details, payment guidelines, along with terms and policies. Often take time to look into the help along with FAQ areas to get a better idea of the way the shop is effective, what they can perform for you, and in what way you can maximize the features.

https://www.economyjack.com/teachers-ethics-group-advocates-for-ethical-conduct-in-tennessee-schools

Thanks for your advice on this blog. Just one thing I would like to say is the fact that purchasing electronic devices items from the Internet is nothing new. Actually, in the past decades alone, the marketplace for online electronic devices has grown drastically. Today, you will discover practically virtually any electronic tool and gizmo on the Internet, including cameras and also camcorders to computer spare parts and gambling consoles.

https://t8614.com/?s=ED86A0ED86A0EC82ACEC9DB4ED8AB8EFBD9Bhttps://mtpolice.krEFBD9DECB9B4ECA780EB85B8EAB280ECA69DE38080EBA994EC9DB4ECA080EC82ACEC9DB4ED8AB8E38080EBA8B9ED8A80ED8FB4EBA6ACEC8AA4E38080EBA994EC9DB4ECA080EB8680EC9DB4ED84B0E38080EC9588ECA084EC82ACEC9DB4ED8AB8

I just could not go away your website before suggesting that I actually loved the standard info a person supply on your guests? Is gonna be back often to check up on new posts

https://Bestmaxcoupons.com/

Many thanks for sharing these wonderful posts. In addition, the optimal travel as well as medical insurance strategy can often eliminate those concerns that come with touring abroad. A medical emergency can shortly become costly and that’s certain to quickly place a financial impediment on the family finances. Setting up in place the perfect travel insurance offer prior to setting off is worth the time and effort. Cheers

https://advance-esthetic.us/celluma-pro-led-light-therapy-device-for-sale

I?ve read several good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to make such a fantastic informative site.

https://rpp.bapenda.jatengprov.go.id/penatausahaan/store/mawartoto/

wow, awesome blog article.Thanks Again. Cool.

https://daxtromn-power.com/products/special-offer-daxtromn-power-mppt-4.2kw-hybrid-solar-inverter-24vdc-batteryless-working-pv-input-90-450v-grid-tie-hybrid-solar-inverter-48v-220v-120-450vdc-140a-mppt-solar-controller-dual-ouput-photovoltaic-inverter

Hi there! I know this is kind of off topic but I was wondering which blog platform are you using for this website? I’m getting sick and tired of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform. I would be fantastic if you could point me in the direction of a good platform.

https://thesoftware.shop/

Im thankful for the blog. Really Great.

https://www.us-machines.com/

I like the valuable information you provide in your articles. I?ll bookmark your blog and check again here regularly. I’m quite certain I will learn many new stuff right here! Best of luck for the next!

https://proscost.com/

Wow, great article post.Much thanks again. Great.

https://daxtromn-power.com/products/special-offer-daxtromn-power-mppt-4.2kw-hybrid-solar-inverter-24vdc-batteryless-working-pv-input-90-450v-grid-tie-hybrid-solar-inverter-48v-220v-120-450vdc-140a-mppt-solar-controller-dual-ouput-photovoltaic-inverter

What?s Going down i’m new to this, I stumbled upon this I’ve discovered It positively helpful and it has helped me out loads. I hope to give a contribution & assist different customers like its helped me. Great job.

https://www.couponwcode.com/

Hey, thanks for the blog article.Much thanks again. Keep writing.

https://daxtromn-power.com/products/special-offer-daxtromn-power-6.2kw-solar-inverter-24vdc-48vdc-hybrid-mppt-6200w-pure-sine-wave-hybrid-charge-controller-120a-off-grid-on-grid

Looking forward to reading more. Great blog post.Really thank you! Really Great.

https://www.us-machines.com/

Great, thanks for sharing this blog post.Really thank you! Really Cool.

https://bingoplus.net.ph

Thanks so much for the blog.Really thank you! Really Great.

https://crushon.ai/

Appreciate you for sharing these kind of wonderful threads. In addition, the best travel along with medical insurance system can often eradicate those worries that come with traveling abroad. Any medical crisis can before long become very expensive and that’s likely to quickly place a financial load on the family finances. Putting in place the suitable travel insurance deal prior to setting off is definitely worth the time and effort. Cheers

https://www.wattpad.com/user/mt_policekr

I really enjoy the blog post.Thanks Again. Awesome.

https://crushon.ai/trends/nsfw_ai

Thank you ever so for you post.Much thanks again. Keep writing.

https://tangtoutiaosite.com/

Really appreciate you sharing this article post. Awesome.

https://www.koluse.com/

Major thanks for the article post.Much thanks again.

https://undressai.cc

okmark your weblog and check again here regularly. I’m quite sure I?ll learn many new stuff right here! Good luck for the next!

https://www.realdildos.com/snake-dildos/

Thanks for sharing, this is a fantastic blog.Thanks Again. Really Great.

https://outingtribe.com

Awesome article post.Much thanks again. Fantastic.

https://www.lunaproxy.com

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but other than that, this is magnificent blog. A great read. I’ll certainly be back.

https://www.male-sex-toy.com/cock-rings/

Thanks for sharing, this is a fantastic blog. Awesome.

https://www.panmin.com.es

Looking forward to reading more. Great blog article.Much thanks again. Fantastic.

https://www.paidusolar.com

I cannot thank you enough for the article.Much thanks again. Want more.

https://casinoplus.net.ph

Your home is valueble for me. Thanks!?

https://www.chocolateok.com/chocolate-cooling-tunnels/

This is one awesome article post. Want more.

https://www.birthdayblooms.com/showcase?page=1

I value the blog article.Really looking forward to read more. Keep writing.

https://cncmachining-custom.com

This is one awesome post.Really thank you! Great.

https://nsfws.ai/

Thanks so much for the article.Really thank you! Great.

https://crushon.ai/

very good submit, i actually love this web site, keep on it

http://36.94.83.205/pbb/assets/css/mawartoto/

terrapins

https://www.shakinthesouthland.com/users/CiteRoyale

Great, thanks for sharing this post.Really thank you! Cool.

https://crushon.ai/character/503eeebe-1626-45bf-89e9-8614106dc5ab/details

I loved your blog post.Really thank you! Really Great.

https://crushon.ai/

I was recommended this web site by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my trouble. You’re amazing! Thanks!

https://25wingbolaofc.xyz/

I think this is a real great blog article.Really thank you! Really Cool.

https://aichatting.ai/

Hey, thanks for the article post.Much thanks again. Really Cool.

https://cncmachining-custom.com

I’m curious to find out what blog system you’re working with? I’m experiencing some small security issues with my latest blog and I would like to find something more safe. Do you have any suggestions?

https://jntconnectrun.com/hubungi/penting/data13/

Thanks a lot for the blog article.Thanks Again. Fantastic.

https://creatiodesign.net

A big thank you for your article. Want more.

https://www.wikitrade.com/en

Thank you for sharing indeed great looking !

volets-roulants-montpellier.pro

Major thanks for the article. Really Great.

https://www.findalocallawyer.com

There are certainly a whole lot of particulars like that to take into consideration. That is a nice point to carry up. I provide the ideas above as basic inspiration but clearly there are questions like the one you convey up where a very powerful thing shall be working in honest good faith. I don?t know if greatest practices have emerged around things like that, but I am positive that your job is clearly recognized as a good game. Each girls and boys really feel the influence of only a second?s pleasure, for the remainder of their lives.

https://rektorika.syekhnurjati.ac.id/sekolah/?googleads=alexistogel20togel

Excellent read, I just passed this onto a friend who was doing some research on that. And he just bought me lunch since I found it for him smile Thus let me rephrase that: Thank you for lunch!

https://dpkp.banjarkab.go.id/wp-content/uploads/?products=alexistogel

Fantastic blog post. Will read on…

https://www.kubet.fyi/

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m sure, you have a great readers’ base already!

https://akademik.poltekkespalu.ac.id/mawartoto/

A great post without any doubt.

chronovolets.com

I really liked your blog article.Really thank you! Keep writing.

https://bonitocase.com/

Almanya medyum haluk hoca sizlere 40 yıldır medyumluk hizmeti veriyor, Medyum haluk hocamızın hazırladığı çalışmalar ise bağlama büyüsü ve aşık etme büyüsü , Konularında en iyi sonuç ve kısa sürede yüzde yüz için bizleri tercih ediniz. İletişim: +49 157 59456087

https://medyum.carrd.co/

I value the post.Thanks Again. Keep writing.

https://7ballbest.com

Fascinating blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog jump out. Please let me know where you got your design. Kudos

https://www.violanation.com/users/NathenW

Thank you for sharing indeed great looking !

depann-volet-79.fr

I really liked your blog post. Will read on…

https://www.oneuedu.com/visa

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say wonderful blog!

https://www.fjstat.com/Honey-refractometer.html

There are some interesting closing dates on this article but I don?t know if I see all of them middle to heart. There’s some validity however I’ll take hold opinion till I look into it further. Good article , thanks and we wish extra! Added to FeedBurner as nicely

https://www.threadrollingmachinery.com/Wire-Bending-Machine-c103684/

Hey very nice blog!! Man .. Beautiful .. Amazing .. I will bookmark your web site and take the feeds also?I am happy to find so many useful information here in the post, we need work out more techniques in this regard, thanks for sharing. . . . . .

http://himasta.fsm.undip.ac.id/wp-content/hasta/

I just could not depart your web site prior to suggesting that I extremely loved the standard information a person supply on your visitors? Is going to be back regularly in order to inspect new posts

https://puspa.kemenpppa.go.id/nahan-berak/?maghrib=mawartoto20rtp20slot

Almanya medyum haluk hoca sizlere 40 yıldır medyumluk hizmeti veriyor, Medyum haluk hocamızın hazırladığı çalışmalar ise bağlama büyüsü ve aşık etme büyüsü , Konularında en iyi sonuç ve kısa sürede yüzde yüz için bizleri tercih ediniz. İletişim: +49 157 59456087

https://medyum.carrd.co/

I have realized that in digital cameras, exceptional detectors help to {focus|concentrate|maintain focus|target|a**** automatically. Those kind of sensors with some video cameras change in in the area of contrast, while others start using a beam with infra-red (IR) light, specifically in low light. Higher standards cameras at times use a blend of both methods and likely have Face Priority AF where the digital camera can ‘See’ a face while keeping your focus only upon that. Thanks for sharing your notions on this website.

http://himasta.fsm.undip.ac.id/wp-content/hasta/

I have been browsing online greater than 3 hours as of late, but I never discovered any interesting article like yours. It is pretty worth enough for me. In my view, if all webmasters and bloggers made excellent content as you did, the net might be a lot more useful than ever before.

https://puspa.kemenpppa.go.id/nahan-berak/?maghrib=mawartoto20rtp20slot

I do love the manner in which you have presented this particular matter plus it does supply me some fodder for consideration. Nonetheless, coming from just what I have personally seen, I simply hope when other responses pack on that people today remain on point and in no way start upon a soap box of the news of the day. Still, thank you for this excellent piece and although I can not really concur with the idea in totality, I regard the perspective.

https://crypto-jackpots.com

My brother recommended I might like this website. He was entirely right. This post actually made my day. You cann’t imagine just how much time I had spent for this info! Thanks!

https://crypto-jackpots.com

Almanya medyum haluk hoca sizlere 40 yıldır medyumluk hizmeti veriyor, Medyum haluk hocamızın hazırladığı çalışmalar ise berlin medyum papaz büyüsü, Konularında en iyi sonuç ve kısa sürede yüzde yüz için bizleri tercih ediniz. İletişim: +49 157 59456087

https://medyumlar.simdif.com/

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m confident, you have a huge readers’ base already!

https://www.youtube.com/watch?v=7Ts8tPnJFSI

Thanks a lot for sharing this with all of us you really know what you are talking about! Bookmarked. Please also visit my web site =). We could have a link exchange arrangement between us!

https://www.youtube.com/watch?v=7Ts8tPnJFSI

I really like and appreciate your article.Really looking forward to read more. Fantastic.

https://www.oneuedu.com/visa

Say, you got a nice article. Fantastic.

https://casinoplus.net.ph/

Hey I am so grateful I found your weblog, I really found you by accident, while I was browsing on Aol for something else, Anyways I am here now and would just like to say thanks for a fantastic post and a all round interesting blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have bookmarked it and also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the superb job.

https://www.youtube.com/watch?v=7Ts8tPnJFSI

Almanya medyum haluk hoca sizlere 40 yıldır medyumluk hizmeti veriyor, Medyum haluk hocamızın hazırladığı çalışmalar ise papaz büyüsü bağlama büyüsü, Konularında en iyi sonuç ve kısa sürede yüzde yüz için bizleri tercih ediniz. İletişim: +49 157 59456087

https://medyumlar.websites.co.in

You actually make it seem really easy with your presentation but I find this topic to be actually something that I feel I would never understand. It seems too complex and very vast for me. I am looking ahead to your subsequent submit, I will try to get the cling of it!

https://www.youtube.com/watch?v=7Ts8tPnJFSI

Hmm it seems like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to the whole thing. Do you have any recommendations for first-time blog writers? I’d certainly appreciate it.

https://tribratanews.madiun.jatim.polri.go.id/news/?

Thanks for the article.Really looking forward to read more. Will read on…

https://crushon.ai/

Thanks for your text. I would love to say that a health insurance broker also works for the benefit of the particular coordinators of a group insurance. The health insurance broker is given a summary of benefits needed by a person or a group coordinator. What any broker may is seek out individuals and also coordinators which in turn best complement those needs. Then he shows his recommendations and if both parties agree, this broker formulates a legal contract between the two parties.

https://tribratanews.madiun.jatim.polri.go.id/news/?

I really like and appreciate your article.Thanks Again.

https://crushon.ai/

certainly like your website but you have to check the spelling on several of your posts. A number of them are rife with spelling issues and I find it very troublesome to tell the truth nevertheless I will surely come back again.

https://myonlinebillboard.com/industry-case-studies/chiropractic-advertising-using-ctv-tv-ads/

One more thing. It’s my opinion that there are lots of travel insurance websites of respected companies that permit you to enter your trip details and obtain you the insurance quotes. You can also purchase the international travel insurance policy on the net by using your credit card. All you have to do is always to enter your travel specifics and you can begin to see the plans side-by-side. Simply find the package that suits your allowance and needs after which use your credit card to buy the idea. Travel insurance on the web is a good way to begin looking for a dependable company regarding international holiday insurance. Thanks for giving your ideas.

https://myonlinebillboard.com/industry-case-studies/tanning-salon-advertising-using-business-news-storys/

I think this is a real great post.Really thank you! Great.

https://crushon.ai/

Really enjoyed this article.Much thanks again. Will read on…

https://chat.openai.com/g/g-A2YK8Gob6-pdf-ai-gpt-chat-pdf

This is one awesome article.Thanks Again.

https://finewatchcare.com/collections/patek-philippe-watch-protection-films

Im grateful for the article.Really thank you! Awesome.

https://chat.openai.com/g/g-A2YK8Gob6-pdf-ai-gpt-chat-pdf

I loved your post.Thanks Again. Will read on…

https://zhongli998.com

I appreciate you sharing this post.Thanks Again. Will read on…

https://zhongli998.com

Really informative blog.Much thanks again. Cool.

https://tycent520.com

Major thanks for the article post.Really looking forward to read more. Fantastic.

https://www.temporary-fence.com.au

I’m blown away by the quality of this content! The author has obviously put a tremendous amount of effort into investigating and arranging the information. It’s exciting to come across an article that not only gives useful information but also keeps the readers engaged from start to finish. Kudos to him for creating such a remarkable piece!

https://magister.psikologi.unpad.ac.id/wp-includes/Text/?Link=MAWARTOTO

Music began playing when I opened up this site, so irritating!

https://korankaltara.com/akatoto-jadi-dandim-bulungan-danrem-ingatkan-penanganan-covid-19

WONDERFUL Post.thanks for share..more wait .. ?

https://magister.psikologi.unpad.ac.id/wp-includes/Text/?Link=MAWARTOTO

Hello! This is kind of off topic but I need some guidance from an established blog. Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about creating my own but I’m not sure where to begin. Do you have any tips or suggestions? Thanks

https://korankaltara.com/akatoto-jadi-dandim-bulungan-danrem-ingatkan-penanganan-covid-19

After I originally commented I clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I get four emails with the same comment. Is there any method you can take away me from that service? Thanks!

https://juaraku.jayabaya.ac.id/mahasiswa/?googleads=mawartoto

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your weblog? My website is in the exact same niche as yours and my users would genuinely benefit from a lot of the information you provide here. Please let me know if this alright with you. Regards!

https://www.sitehoover.com/onlineworldinformation/

There’s noticeably a bundle to find out about this. I assume you made certain good factors in features also.

https://juaraku.jayabaya.ac.id/mahasiswa/?googleads=mawartoto

Thanks for your posting. My spouse and i have usually noticed that a lot of people are wanting to lose weight as they wish to look slim and also attractive. On the other hand, they do not constantly realize that there are other benefits for you to losing weight in addition. Doctors assert that overweight people suffer from a variety of illnesses that can be directly attributed to their particular excess weight. Thankfully that people who’re overweight and suffering from numerous diseases are able to reduce the severity of their illnesses by simply losing weight. You are able to see a continuous but marked improvement with health if even a moderate amount of weight reduction is achieved.

https://forum.edu.az/profil/oneplay168casino/

Very good blog post.Thanks Again. Want more.

https://www.wiremeshfence.com

I cannot thank you enough for the blog post. Want more.

https://www.clearvufence.co.za

Excellent post. I was checking continuously this blog and I’m impressed! Very helpful information particularly the last part 🙂 I care for such info a lot. I was seeking this certain info for a very long time. Thank you and good luck.

https://siembahpora.jabarprov.go.id/obj/products/mawartoto/

Thanks for your posting. I would love to remark that the very first thing you will need to conduct is determine whether you really need credit improvement. To do that you need to get your hands on a copy of your credit file. That should not be difficult, because the government makes it necessary that you are allowed to get one absolutely free copy of your real credit report each year. You just have to ask the right men and women. You can either read the website for the Federal Trade Commission or maybe contact one of the leading credit agencies right away.

https://siembahpora.jabarprov.go.id/obj/products/mawartoto/