UMACLK-15-M Financial Statement Analysis Assignment Sample

Module code and Title : UMACLK-15-M Financial Statement Analysis Assignment Sample

Tearsheet

The valuation of the present company has been found to stay at $180, and it can be recommended to buy the shares depending on the share price performance of the firm in recent times.

Figure 1: Share Price of McDonald’s over 1 year

(Source: Yahoo Finance, 2021)

The chosen company has been listed under the NYSE with the ticker sign of “MCD” which represents the stock price performance and other financial information about the company in the financial market. As depicted in the above figure, in April 2021, the company has faced a severe downfall in the share price reflecting a lower share price in the capital market depicting a value of $204.8400 bn (Yahoo Finance, 2021).

However, in later months, it has been found that the company with its effective management strategy has efficiently increased the performance in the share market thereby increasing the pierce of shares.

Concerning the present performance of the firm, it can be stated that it has reflected a stable and upward trend movement in the financial market thereupon representing the high potential of the firm in the capital markets.

Although the firm had faced a reduction in the share price showcasing a value of $237.34 in the month of October 2021, the discussed firm has been seen to restore its position in later months (Yahoo Finance, 2021). The present share price of the firm has been $252.94 that implies to move forward reflecting profit-making situation.

In this context, following the non-financial and financial performance of the company, it can be said that this company is good for investment. Moreover, relating to the share price of the company, it can be stated that there is a high chance for the company to increase its price in the financial market because of the potential strategies that can effectively benefit the investors.

Introduction

Investment in a company by an investor refers to the desire of an investor in increasing the income amount that serves the future conditions. The investment decision of an investor highly depends on both financial and non-financial performance analysis that implies the overall stability of a company in the global market.

In this context, the present report analyses the company profile of Mcdonald’s, including its internal and external environment, corporate strategy, competitor analysis, and corporate strategy that covers the non-financial information. Moreover, the study also incorporates financial statement analysis that includes ratio analysis, trend analysis, and cash flow analysis to understand the financial performance of the chosen organisation.

Company’s background

McDonald’s is an American fast-food company dealing with burgers and wraps which is headquartered in Chicago, United States. At present, the company has established more than 36000 restaurants and in more than 100 countries (McDonald’s, 2021). Furthermore, it has emerged from the history of the company, that the organisation went public on April 21, 1965, thereby listing 12 stock splits.

The company presently operates in the UK thereby having 1300 restaurants in the UK market (Mcdonalds, 2021). It is listed under the “New York Stock Exchange (NYSE)”, and has a market capitalization of $180.92 billion (Market watch, 2021). As per the annual reports, the company has been affected by the Covid-19 spread thereby decreasing its sales revenue in 2020 compared to other years.

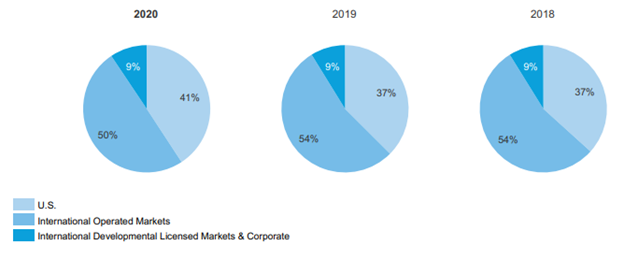

Figure 2: Segment revenues of McDonald

(Source: Annual Reports, 2020)

Concerning the annual reports of this firm, it has been observed that the firm has been earning revenues from reflecting company operations, and other franchised revenues. Furthermore, it came within the purview that the company has been operating in the US market, international operated markets, and international developmental licensed markets and corporate depicting revenue percentage of 50%, 41% and 9% respectively (Annual Reports, 2020).

Upon closer analysis, it has been found that compared to other years of 2018 and 2019, the firm has depicted low revenue earnings reflecting its revenue generated from company operations with a total value of $ 8,139 in 2020.

On the other hand, the firm has earned higher revenue from its franchised operations reflecting a total revenue income of $ 10,726 considering all the segments (Annual Reports, 2020). However, on an overall basis, compared to 2019, the company can be said to have lowered its financial performance with the depiction of lower profitability.

SWOT analysis

In making an investment decision, an investor needs to analyse the internal environment thereby analysing the competitive strength of a certain company (Halmaghi et al. 2017). In this context, a SWOT analysis has been conducted concerning Mcdonald’s that analyses the strengths, weaknesses, threats, and opportunities the company comprises.

| Strength

● Variety in food products ● Technological advancement ● Ranking as the largest fast-food company |

Opportunities

● Price affordability can attract customers in the market ● Expansion in business to Asian countries for high market opportunities |

| Weakness

● Existence of material weakness (Annual reports, 2020). ● Decrease in annual revenue due to improper management strategy |

Threats

● Rival companies such as Burger King, KFC, and Subway (Owler, 2021). |

Table 1: SWOT analysis for MCD

(Source: Self-developed)

As per the above table, it can be stated that the selected company has been stable internally; however, it has a requirement of taking proper management strategy to overcome the situation of the Covid-19 pandemic that has drastically lowered the revenue generation capacity of the organisation (Annual reports, 2020).

Moreover, technological assistance has been a potential strength that can effectively drive out the competitors in the market such as KFC, Burger King, and Subway (Owler, 2021). However, with the appropriate pricing strategy, the firm has gained the opportunity of increasing its customer base thereby attracting customers providing quality food at affordable prices.

Industry analysis

External analysis of a company essentially depicts the industry analysis thereby assessing the factors in the external environment and their potential in affecting the business operations of a company (Shtal et al. 2018). In this respect, a PESTLE analysis has been undertaken that reflects the information about the specific factors.

PESTLE

Political

The global food chain is subjected to pay taxes, such as sales tax, and payroll to the government of a specific country (Potvin, et al., 2019). In this context, the political scenario of the UK has been analysed. In the UK, there has been an unstable political scenario due to mismanagement of the Covid situation by the UK government (Santander Trade, 2021).

There has been a replacement of five ministers On the other hand, following the different laws and regulations provided by the UK government concerning food companies, the “Food safety Act 1990” has been helping the food companies in the UK market thereby supporting the business operations (Food.gov.UK, 2021).

Economical

Concerning the economic stability of the UK, it has been observed that the Brexit movement has slowed the economic growth of the country along with the Covid-19 effect thereupon reducing the GDP rate by 2.2% (Santander Trade, 2021).

On the other hand, due to the adverse effect of the pandemic, consumer behaviour changed reflecting the dependence of customers on essential products including food items. This has been a highly challenging issue that can potentially affect the business operations of the chosen company thereby reducing its customer base within the UK market.

Social

It has been found that at present the UK has a population of over 68 million thereby having a large consumer market (Worldometer, 2021). Moreover, it has emerged from studies that the people of the UK have advanced their culture thereby accepting new regulations and technological advancement.

This has efficiently enabled the discussed company in establishing its brand within the market thereby providing a variety of food to the customers at affordable prices (Mcdonalds, 2021).

Technological

Technology is an important element in today’s business context that increases the competitive strength. As per the views of Cao and Iansiti (2021), technology has essentially helped companies in increasing their innovative capacity thereby increasing the sustainability rate with effective business activities.

Depending on this view, it has been found that the UK has developed itself technologically and is currently considered a technological hub for business organisations. For instance, in the food industry, digital technology, and artificial intelligence technology have found a way that improve the business structure of organisations (Short et al. 2021). McDonald’s, in this regard, has been found to integrate digital technologies that support its business operations within the selected market (Annual reports, 2020).

Environmental

In recent times, it has been observed that the UK government has taken necessary actions in reducing the negative impacts of human activities that affect the environment.

Moreover, concerning the Covid-19 situation, the government has been quick enough in manufacturing vaccines for people that benefited the society and brought back normalcy within the country (Ons.gov.UK, 2021). This has immensely helped the mentioned firm in restoring their business activities thereby helping customers in having their food products.

Legal

The last factor that is essentially important to analyse is the legal factors that affect the business operations of the concerned firm. For instance, in the UK, this company has to adopt a more “flexible working force” to increase the “zero-hour contracts”. In the discussion of legal regulations, this prevents employees from receiving holidays and payment for sick leaves.

Competitor analysis

In the current business environment, it has become relevant to assess the competitive atmosphere of an organisation thereby analysing the market forces that affect a firm. As per the opinion of Melina and Berliana (2021), Porter’s five forces model essentially helps to analyse the market forces thereby evaluating five components. Thus, a Porter analysis has been conducted for McDonald’s Company analysing the five factors.

Porter’s five forces

Bargaining power of suppliers: Low

In the present market, it has been found that fast-food companies are emerging which essentially increases the number of suppliers in the market. In this context, due to the availability of several suppliers who provide the ingredients that are necessary for food production, the bargaining power of suppliers has been reduced. This has been an advantage for the concerned company as they have been able to get necessary raw materials at the cheapest prices.

Bargaining power of buyers: High

In the UK market, it has been found that there are many fast food companies with a range of food products. In this context, it can be said that the power of customers has been high as they have alternative options available to them. Following this situation, it can be stated that the concerned company, despite setting up the pricing strategy, can face high bargaining power from the buyers as there are companies with various products that can satisfy the customers’ demand alternatively.

Threats of substitution: High

In the Uk market, substitution possibility has been high as there are many food substitutions such as homemade foods, bakeries, and other products that often compete with McDonald’s food products. This essentially represents a high threat to the present company as customers in the market have a chance of opting for the substituted products.

Moreover, in the times of Covid-19. it has been found that consumer taste and preferences have changed thereby making them rely on healthier food. This, in turn, puts forwards the understanding that the mentioned firm needs to look over the market demands and produce goods accordingly to decrease the substitution threat.

Threat of new entrants: Low

As the UK has been a technological hub, therefore, it has been found that many companies have an interest in establishing their brand in the market. Moreover, the suitability of the food laws also assists the thought of new entrepreneurs supporting their business goals. However, concerning advanced technology, it can be said that it is expensive that makes the new startup companies step back thereby decreasing the threat.

Threat of rivalry: High

Mcdonald has numerous rival competitors in the market such as Subway, Burger King, and KFC which potentially threatens the company. Moreover, it has been observed that all the companies have been efficient enough in increasing their technological services thereby giving high competition to the concerned company. In this regard, it can be said that the discussed firm has a high chance of facing threats concerning competition in the market.

Business Model and corporate strategy

Business model

McDonald’s, the largest fast-food firm, has been established on a franchised-based business model. As per the annual report information, the brand consists of 93% of franchise restaurants thereby setting a primary goal of increasing the percentage to 96% (FourWeekMBA. 2020).

Upon closer analysis, it has been found that the organisation has been capable enough in managing its capital indulging small investors in the market thereby expanding its brand in different countries (Mcdonalds, 2021). Ray Kroc, the former CEO of Mcdonald’s, has been considered as the “father of the McDonald’s revenue model” for developing franchising techniques perfectly.

Under his instruction, the company has been expanding its business without compromising the food quality (Bhasin, 2020). This, in turn, enabled the firm to generate high revenue thereby becoming the leader of its franchisee. However, in 2020, the franchises have been adversely affected by the Covid-19 pandemic that made the company grant deferral royalties earned in all the operating markets along with cash collection for specific rents (Annual reports, 2020).

The business model consists of three important goals reflecting the strategies to regain the customers in the market by improving the quality of food and tastes. Moreover, the company aims to create a strong value in the market and provide the best customer service that can essentially help them in gaining a wider market base.

Furthermore, it also has the goal of turning its present customer base into a permanent one thereby increasing the loyalty level (Annual Reports, 2020). Concerning the long-term strategy, the firm has aimed at transitioning the franchising model as stated above. Furthermore, relating to the rent and royalty income, the company efficiently constructed consistent and predictable revenue earnings with lower operating costs.

Corporate strategy:

In 2020, McDonald’s announced a new corporate strategy for growth and development of the company, which establishes the business as the leader of the “global Omni-channel restaurant brand”. Their franchisee offers services around the world, guides behaviour and actions, getting competitive strategies (McDonald’s. 2021).

Upon closer analysis, it has been found that the concerned firm has been undertaking a new strategy concerning diversity, equity, and inclusion that can assist the accountability system of the firm (Annual reports, 2020). However, the company has been also undertaking a holistic strategy to improve the environment that supports society and increases the sustainability rate.

Financial statement analysis

Financial performance analysis refers to the assessment of financial information disclosed by a company in its annual reports. As per the words of Easton et al (2018), it is the analysis of the financial statement that provides detailed information concerning the financial performance of a company.

In addition, it has been mentioned that in most cases, the financial performance of a firm is analysed with the help of key financial ratios such as liquidity, and profitability ratios.

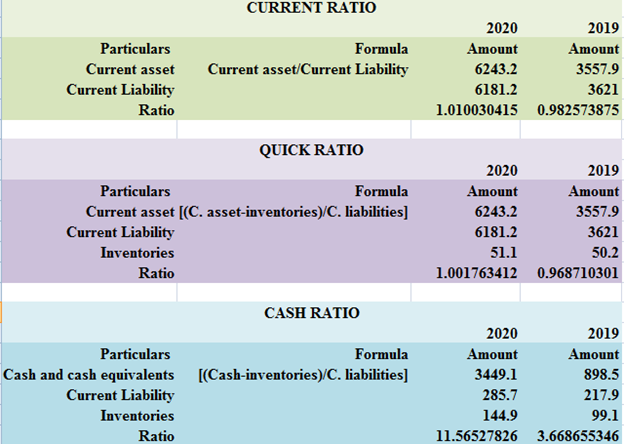

Liquidity ratio

Figure 3: Liquidity ratio analysis

(Source: Self-developed)

The above figure potentially analyses the liquidity capacity of the concerned firm thereby assessing the current, quick, and cash ratio. As stated by Sari et al. (2018), liquidity ratio supports a company in analysing the liquid cash availability to them for paying off the short-term liabilities. In addition, it has been said that the standard industry level ratio is considered to stay between 1 to 2, which defines a company as having enough liquid cash. In this regard, compared to 2019, it can be said that in 2020, the company has improved its liquidity capability depicting a stable ratio of 1 concerning both quick, and current ratios. This has been due to the ability of the firm to rely on this franchising method thereby collecting cash from small investors that enabled them to meet the short-term obligations (Annual Reports, 2020). However, the cash ratio has been low despite increasing a bit from the 2019 value depicting a 0.55 cash ratio.

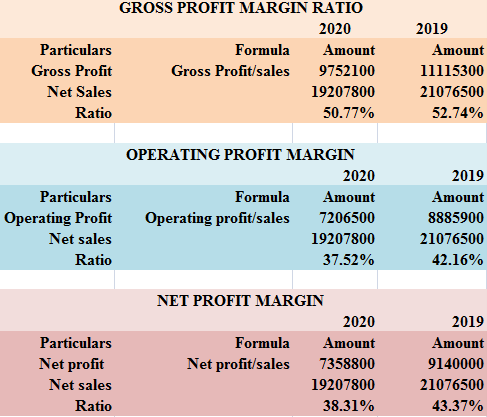

Profitability ratio

Figure 4: Profitability ratios

(Source: Self-developed)

Profitability ratio refers to the analysis of the profit-generation capacity of a firm that improves the position in the market and also enhances the market value of a company. In the words of Husain and Sunardi (2020), the assessment of gross profit margin, operating margin, and net profit margin, a company exceptionally gains an idea about its profitability position in the global market considering the industry ratio of 20%.

Based on this opinion, it is evident from the above figure that the profitability condition of the company has decreased in 2020 compared to 2019. This has been solely due to the Covid-19 pandemic that reduced the sales of the company due to changes in consumer taste and preference. However, despite a downfall, it can be stated that the company has been performing excellently concerning the industry level.

In this area of discussion, it can be stated that the company has been financially stable although it has a need to increase its revenue earnings thereby boosting sales.

Trend analysis

Trend analysis of a firm refers to the assessment of performances of a company over certain years concerning financial data thereby analysing trend pr consistent results. As per the words of Ali (2020), trend analysis essentially helps an investor in understanding the stability rate of a firm thereby analysing fluctuations, and consistency regarding performance in the financial market.

Following this opinion, a five-year-based trend analysis has been integrated that represents the share price of the mentioned organisation thereupon understanding the trend set over these years.

Figure 5: Share Price over 5 years of MCD

(Source: Yahoo Finance, 2021)

Concerning the above figure, it can be stated that the company had gone through several ups and downs in five years starting from 2017 to 2021 reflecting fluctuations. It has been found that in January 2021, the company has been trading with a share price of $120.76 billion depicting the lowest share price compared to other years (Yahoo Finance, 2021).

In 2018, after a certain growth in the share price, there has been a downfall of the price of the shares depicting a value of $148.27 billion. However, in 2019, the company restores its position in the financial market thereby increasing its share price and representing an upward trend. The share price in 2019 has been $221.15 billion considering the highest of the season (Yahoo. Finance, 2021).

The effect of Covid-19 has been drastic that essentially reducing the high performance of the company and reducing the share price to $148.40 billion showcasing a severe downfall compared to the previous year. In this context, with effective management strategies including DEI, environmental, and sustainable strategies, the company has recently reflected an upward trend depicting a share price of $242.77 billion (Yahoo Finance, 2021).

Therefore, it can be stated that the company has been incapable of setting up a proper trend but has essentially decided to maintain the upward trend in future years.

Basic free cash flow Model

Cash flow statement essentially analyses the inflows and outflows of cash into the company concerning business operations. As raised from the annual reports, the net income of the company has been the lowest, depicting a value of $ 4,730.5 million in 2020 compared to $$ 6,025.4 in 2019 (Annual reports, 2020).

Upon closer look into the cash flow statement, it came within purview that the cash availability at the beginning of the year has been lower compared to the end of the year. This essentially showcased how well the company has performed to restore its cash balance depicting growth and development.

Conclusion

It can thus be concluded that although the revenue generation has been low in 2020, yet the company has financially performed well. However, concerning strategies, it has also developed its policies and strategies that support the business activities in the times of pandemic situations.

Reference List

Ali, A., 2020. Financial performance and size determinants: growth trend and similarity analysis of Indian pharmaceutical industry. Humanities & Social Sciences Reviews, 8(4), pp.547-560.

Annual reports, 2020. Annual Report 2020 Available at https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_MCD_2020.pdf [Accessed on 20/10/21]

Cao, R. and Iansiti, M., 2021. Growth, Transformation and Digital Capital: The Importance of Technological and Organizational Architecture. Harvard Business School Research Paper Series, (21-122).

Easton, P.D., McAnally, M.L., Sommers, G.A. and Zhang, X.J., 2018. Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers.

Food.gov.UK, 2021. Key regulations Available at https://www.food.gov.uk/about-us/key-regulations [Accessed on 20/10/21]

Halmaghi, E.E., Iancu, D. and Băcilă, M.L., 2017. The organization’s internal environment and its importance in the organization’s development. In International Conference Knowledge-Based Organization (Vol. 23, No. 1, pp. 378-381).

Market watch, 2021. McDonald’s Corp. Available at https://www.marketwatch.com/investing/stock/mcd [Accessed on 20/10/21]

McDonalds, 2021. About Us Available at https://www.mcdonalds.com/us/en-us/about-us.html [Accessed on 20/10/21]

Mcdonalds, 2021. Your Right To Know Available at https://www.mcdonalds.com/gb/en-gb/help/faq/18510-how-many-mcdonalds-restaurants-are-there-in-the-uk-and-the-world.html [Accessed on 20/10/21]

Ons.gov.UK, 2021. UK Environmental Accounts: 2021 Available at https://www.ons.gov.uk/economy/environmentalaccounts/bulletins/ukenvironmentalaccounts/2021 [Accessed on 20/10/21]

Owler, 2021. McDonald’s Available at https://www.owler.com/company/mcdonalds [Accessed on 20/10/21]

Santander Trade, 2021. United Kingdom UNITED KINGDOM: ECONOMIC AND POLITICAL OUTLINE Available at https://santandertrade.com/en/portal/analyse-markets/united-kingdom/economic-political-outline [Accessed on 20/10/21]

Sari, R.K., Nurlaela, S. and Titisari, K.H., 2018, August. The Effect of Liquidity Ratio, Profitability Ratio, Company Size, and Leverage on Bond Rating in Construction and Real Estate Company. In PROCEEDING ICTESS (Internasional Conference on Technology, Education and Social Sciences).

Short. S, Strauss. B, and, Lotfian. P, 2021. Emerging technologies that will impact on the UK Food System Available at https://www.food.gov.uk/sites/default/files/media/document/emerging-technologies-report.pdf [Accessed on 20/10/21]

Shtal, T., Buriak, M., Ukubassova, G., Amirbekuly, Y., Toiboldinova, Z. and Tlegen, T., 2018. Methods of analysis of the external environment of business activities.

Yahoo Finance, 2021. McDonald’s Corporation (MCD) Available at https://finance.yahoo.com/quote/MCD/chart?p=MCD# [Accessed on 20/10/21]

Know more about UniqueSubmission’s other writing services: